Question: Supp SSS Problem 4-2 (Individual Tax Payable - 7 Cases) Seven independent Cases follow. Each case involves various assumptions as to the amount and type

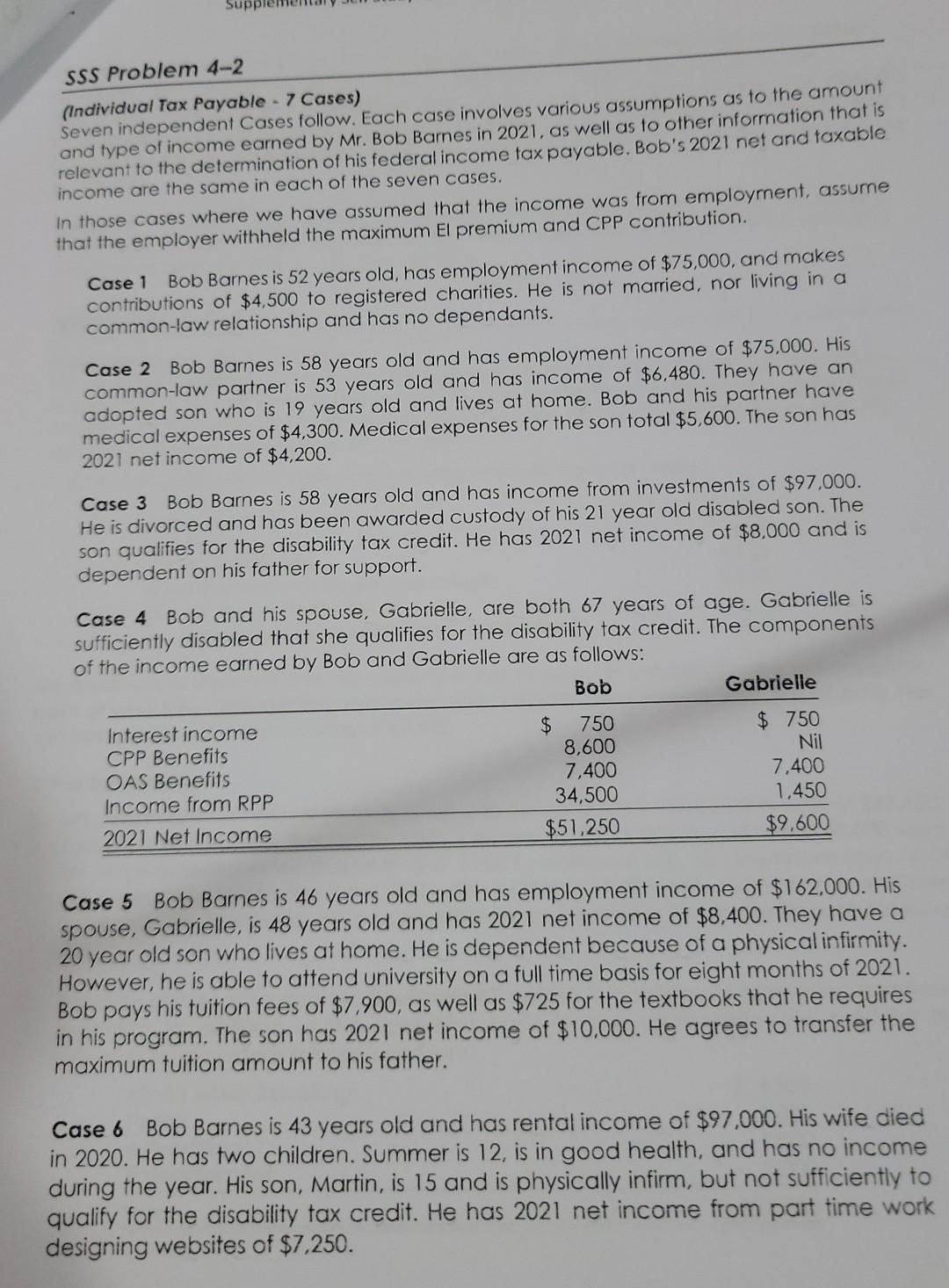

Supp SSS Problem 4-2 (Individual Tax Payable - 7 Cases) Seven independent Cases follow. Each case involves various assumptions as to the amount and type of income earned by Mr. Bob Barnes in 2021, as well as to other information that is relevant to the determination of his federal income tax payable. Bob's 2021 net and taxable income are the same in each of the seven cases. In those cases where we have assumed that the income was from employment, assume that the employer withheld the maximum El premium and CPP contribution. Case 1 Bob Barnesis 52 years old, has employment income of $75,000, and makes contributions of $4,500 to registered charities. He is not married, nor living in a common-law relationship and has no dependants. Case 2 Bob Barnes is 58 years old and has employment income of $75,000. His common-law partner is 53 years old and has income of $6,480. They have an adopted son who is 19 years old and lives at home. Bob and his partner have medical expenses of $4,300. Medical expenses for the son total $5,600. The son has 2021 net income of $4,200. Case 3 Bob Barnes is 58 years old and has income from investments of $97,000. He is divorced and has been awarded custody of his 21 year old disabled son. The son qualifies for the disability tax credit. He has 2021 net income of $8,000 and is dependent on his father for support. Case 4 Bob and his spouse, Gabrielle, are both 67 years of age. Gabrielle is sufficiently disabled that she qualifies for the disability tax credit. The components of the income earned by Bob and Gabrielle are as follows: Bob Gabrielle Interest income CPP Benefits OAS Benefits Income from RPP 2021 Net Income $ 750 8,600 7,400 34,500 $51,250 $ 750 Nil 7,400 1,450 $9.600 Case 5 Bob Barnes is 46 years old and has employment income of $162,000. His spouse, Gabrielle, is 48 years old and has 2021 net income of $8,400. They have a 20 year old son who lives at home. He is dependent because of a physical infirmity. However, he is able to attend university on a full time basis for eight months of 2021. Bob pays his tuition fees of $7.900, as well as $725 for the textbooks that he requires in his program. The son has 2021 net income of $10,000. He agrees to transfer the maximum tuition amount to his father. Case 6 Bob Barnes is 43 years old and has rental income of $97,000. His wife died in 2020. He has two children. Summer is 12, is in good health, and has no income during the year. His son, Martin, is 15 and is physically infirm, but not sufficiently to qualify for the disability tax credit. He has 2021 net income from part time work designing websites of $7.250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts