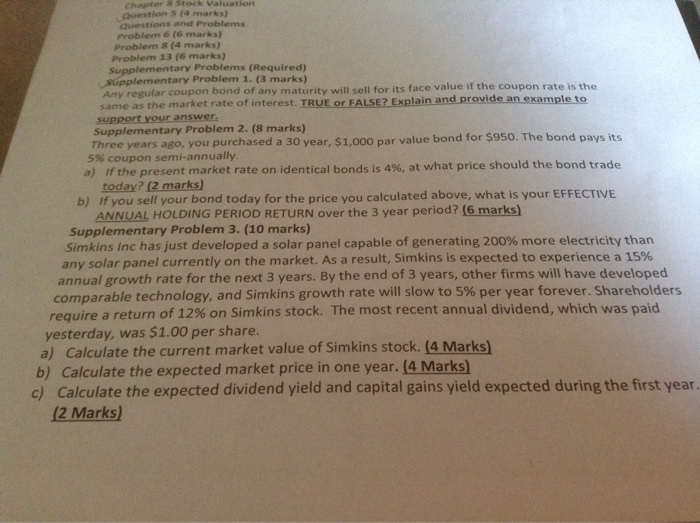

Question: Supplementary problems 2&3 Chapter s stock valuation s (4 marks) Questions and Problems Problem 6 (6 marks) Problem 8 (4 marks) Problem 13 (6 marks)

Supplementary problems 2&3

Supplementary problems 2&3Chapter s stock valuation s (4 marks) Questions and Problems Problem 6 (6 marks) Problem 8 (4 marks) Problem 13 (6 marks) supplementary Problems (Required) supplementary Problem 1. (3 marks) value if the coupon rate is the Any regular coupon bond of any maturity will sell for its face same as the market rate of interest. TRUE or FALSE? Explain and provide an example to support your answer. supplementary Problem marks) its purchased a 30 year, si,ooo par value bond for S950. The bond pays 5% coupon the bond trade a) if present market rate on identical bonds is 4%, at what price should today marks. b) if you sell your bond today for the price you calculated ab what is your EFFECTIVE ANNUAL HOLDING PERIOD RETURN over the 3 year period? (6 marksh Supplementary Problem 3. (10 marks) Simkins Inc has just developed a solar panel capable of generating 200% more electricity than any solar panel currently on the market As a result, Simkins is expected to experience a annual growth rate for the next 3 years. By the end of 3 years, other firms will have developed comparable technology, and Simkins growth rate will slow to 5% per year forever. Shareholders require a return of 12% on Simkins stock. The most recent annual dividend, which was paid yesterday, was S1.00 per share. Marks) a) Calculate the current market value of Simkins stock. (4 b) Calculate the expected market price in one year. (A Marks c) Calculate the expected dividend yield and capital gains yield expected during the first year. 12 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts