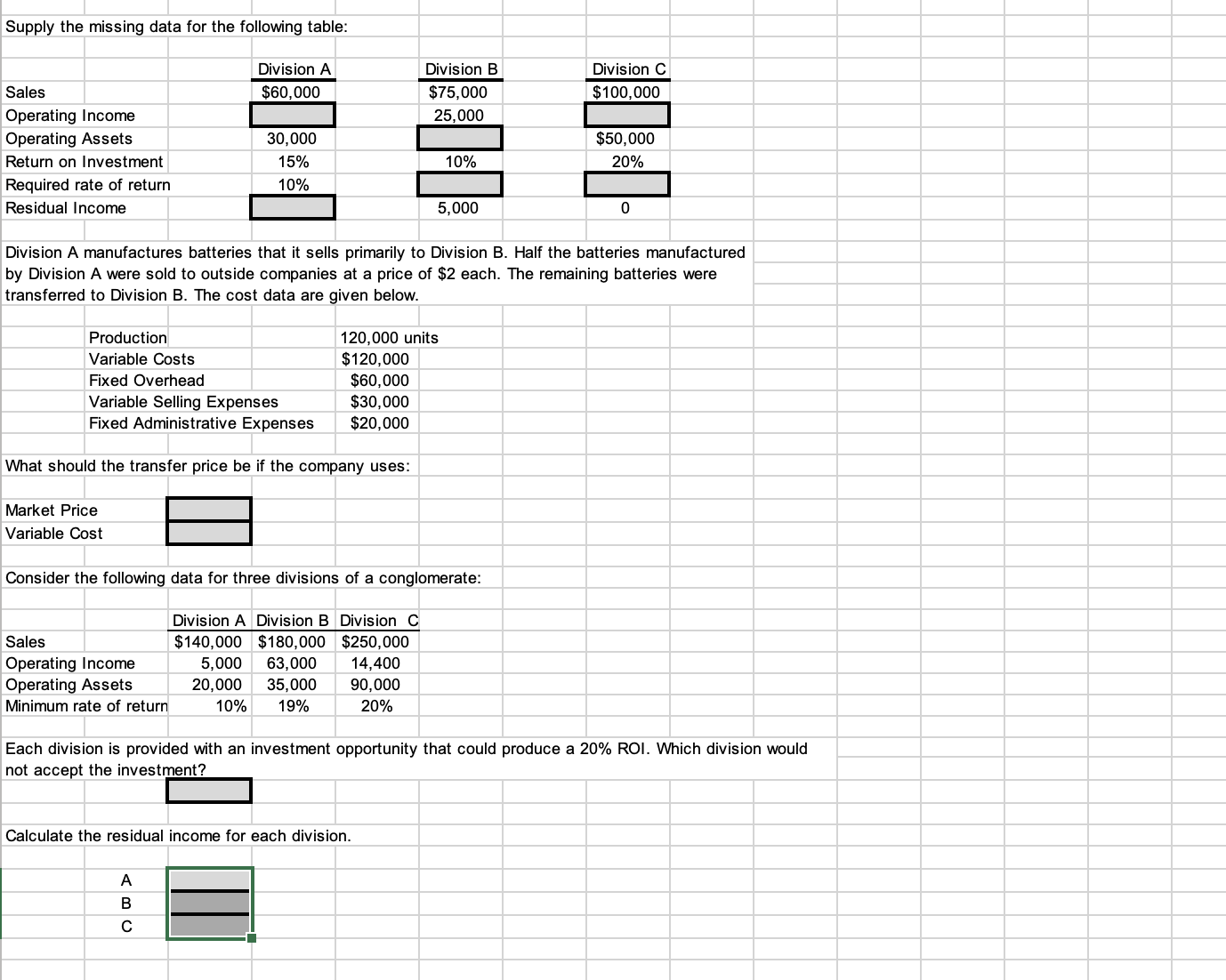

Question: Supply the missing data for the following table: Division A manufactures batteries that it sells primarily to Division B. Half the batteries manufactured by Division

Supply the missing data for the following table: Division A manufactures batteries that it sells primarily to Division B. Half the batteries manufactured by Division A were sold to outside companies at a price of $2 each. The remaining batteries were transferred to Division B. The cost data are given below. Production Variable Costs Fixed Overhead Variable Selling Expenses Fixed Administrative Expenses 120,000 units $120,000 $60,000 $30,000 $20,000 What should the transfer price be if the company uses: Market Price Variable Cost Consider the following data for three divisions of a conglomerate: Sales Operating Income Operating Assets Minimum rate of return Division A Division B Division C \begin{tabular}{|l|l|l|} \hline 140,000 & $180,000 & $250,000 \\ \hline \end{tabular} Division C $100,000 10% 20% 5,000 Each division is provided with an investment opportunity that could produce a 20% ROI. Which division would not accept the investment? Calculate the residual income for each division. A B C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts