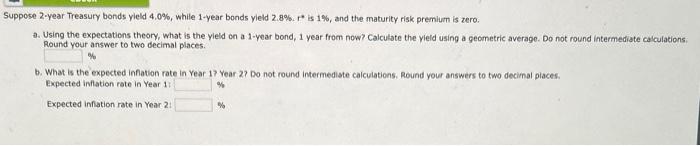

Question: Suppose 2 -year Treasury bonds yleld 4.0%, while 1 -year bonds yield 2.8%. is 1%, and the maturity risk premium is zero. 3. Using the

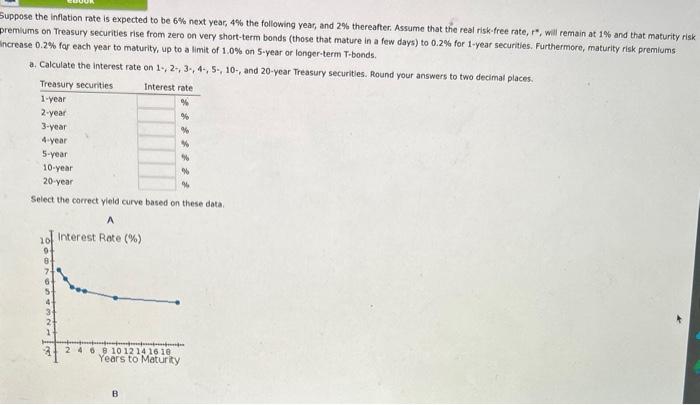

Suppose 2 -year Treasury bonds yleld 4.0%, while 1 -year bonds yield 2.8%. is 1%, and the maturity risk premium is zero. 3. Using the expectations theory, what is the yleld on a 1-year bond, 1 year from now? Calculate the yield using a geometric averago. Do not round intermediate calculations Round your answer to two decimal places. b. What is the expected infation rate in Year 17 Year 27 Do not round intermediste calculations. Round your answers to two decimal piaces. expected inflation rate in Year 1 : Expected innation rate in Year 2: uppose the inflation rate is expected to be 6% next year, 4% the following year, and 2% thereafter. Assume that the real risk-free rate, r, will remain at 1% and that maturity risk remiums on Treasury securities rise from zero on very short-term bonds (those that mature in a few days) to 0.2% for 1 -year securities. Furthermore, maturity risk premiums acrease 0.2% for each year to maturity, up to a limit of 1.0% on 5 -year or longer-term T-bonds. a. Calculate the interest rate on 12,3+45=10 and 20 -year Treasury securities. Round your answers to two decimal places. Select the correct yield curve based on these data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts