Question: Suppose a 10- year zero coupon bond with face value $100 Thank You! Suppose a 10-year zero coupon bond with a face valueof $100 trades

Suppose a 10- year zero coupon bond with face value $100

Thank You!

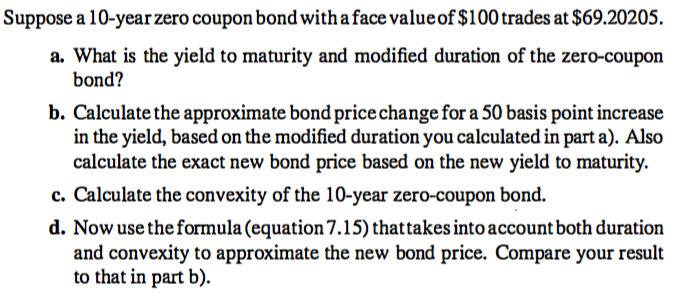

Suppose a 10-year zero coupon bond with a face valueof $100 trades at $69.20205. a. What is the yield to maturity and modified duration of the zero-coupon bond? b. Calculate the approximate bond price change for a 50 basis point increase in the yield, based on the modified duration you calculated in part a). Also calculate the exact new bond price based on the new yield to maturity. c. Calculate the convexity of the 10-year zero-coupon bond. d. Now use the formula (equation 7.15) that takes into account both duration and convexity to approximate the new bond price. Compare your result to that in part b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts