Question: Suppose a bond has face value Face and coupon rate c. The bond has n coupon periods and the coupon frequency is f (where

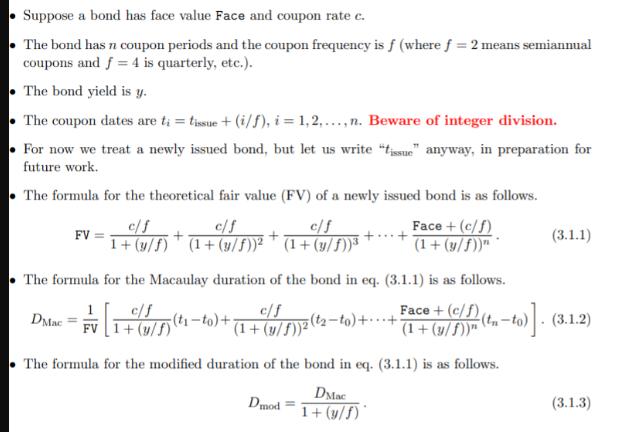

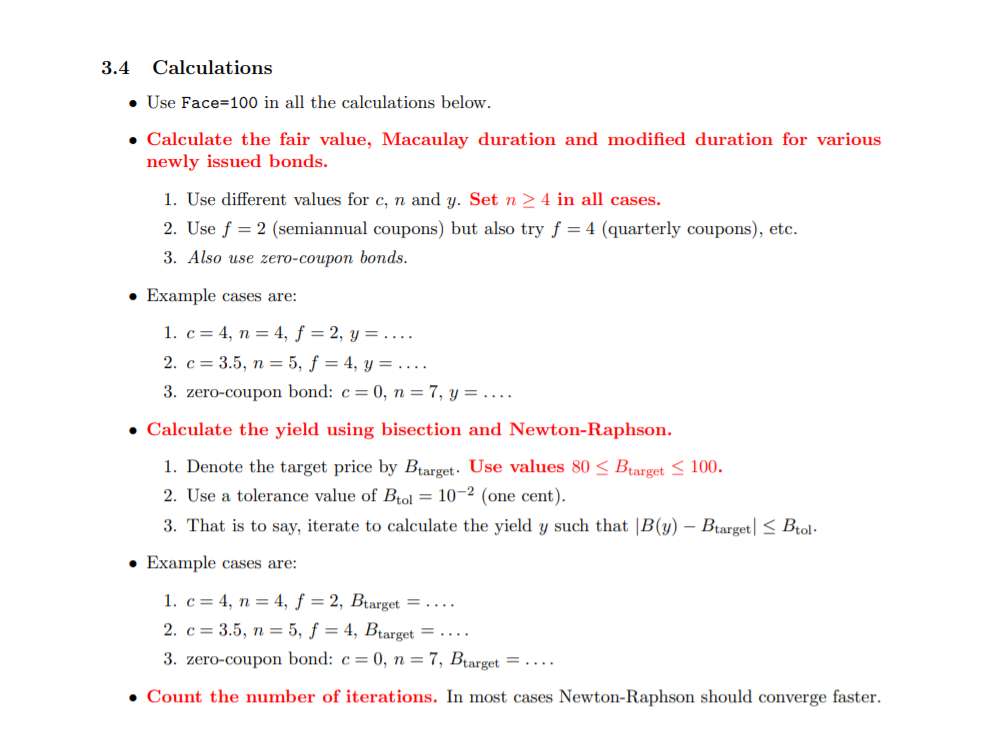

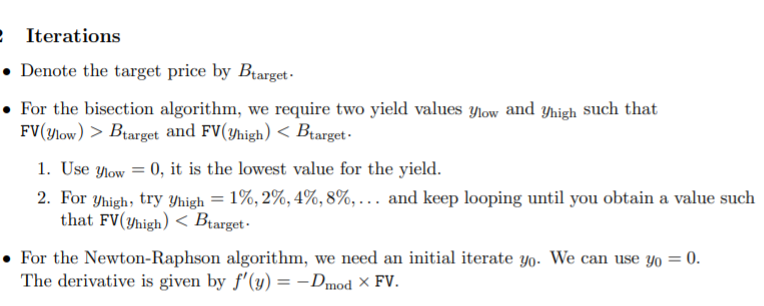

Suppose a bond has face value Face and coupon rate c. The bond has n coupon periods and the coupon frequency is f (where f = 2 means semiannual coupons and f = 4 is quarterly, etc.). The bond yield is y. The coupon dates are ti = tissue + (i/f), i = 1,2,..., n. Beware of integer division. For now we treat a newly issued bond, but let us write "tissue" anyway, in preparation for future work. The formula for the theoretical fair value (FV) of a newly issued bond is as follows. c/f c/f c/f Face +(c/f) (1 + (y/f))" 1+ (y/f) (1+(y/f)) (1+(y/f)) FV= The formula for the Macaulay duration of the bond in eq. (3.1.1) is as follows. [ + c/f 1+(u/f) DMac Face +(c/f) (1 + (y/f))" The formula for the modified duration of the bond in eq. (3.1.1) is as follows. DMac 1 + (y/f) 1 FV ++ (ti-to)+- + (1 + (y/f))2 (2-to) + ... + Dmod (3.1.1) (tn-to)]. (3.1.2) (3.1.3) 3.4 Calculations Use Face=100 in all the calculations below. Calculate the fair value, Macaulay duration and modified duration for various newly issued bonds. 1. Use different values for c, n and y. Set n 4 in all cases. 2. Use f = 2 (semiannual coupons) but also try f = 4 (quarterly coupons), etc. 3. Also use zero-coupon bonds. Example cases are: 1. c = 4, n = 4, f = 2, y = ..... 2. c = 3.5, n = 5, f = 4, y= .... 3. zero-coupon bond: c = 0, n = 7, y = .... Calculate the yield using bisection and Newton-Raphson. 1. Denote the target price by Btarget Use values 80 Btarget 100. 2. Use a tolerance value of Btol = 10-2 (one cent). 3. That is to say, iterate to calculate the yield y such that B(y) - Btarget | Btol. Example cases are: 1. c 4, n = 4, f = 2, Btarget = .... 2. c = 3.5, n = 5, f = 4, Btarget=.... 3. zero-coupon bond: c = 0, n = 7, Btarget=.... Count the number of iterations. In most cases Newton-Raphson should converge faster. Iterations Denote the target price by Btarget. For the bisection algorithm, we require two yield values Ylow and FV (ylow) > Btarget and FV(yhigh) < Btarget. Yhigh such that 1. Use ylow = 0, it is the lowest value for the yield. 2. For thigh, try Yhigh = 1%, 2%, 4%, 8%,... and keep looping until you obtain a value such that FV(high) < Btarget. For the Newton-Raphson algorithm, we need an initial iterate yo. We can use yo = 0. The derivative is given by f'(y) = -Dmod X FV.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Scenario 1 c 4 n 4 f 2 y 1 Fair Value FV FV 42 42 42 1y21y221y23 100 421y2 2 Macaulay Duration Macau... View full answer

Get step-by-step solutions from verified subject matter experts