Question: Suppose a bond's price is expected to decrease by 3% if its market discount rate increases by 50 bps. If the bond's market discount

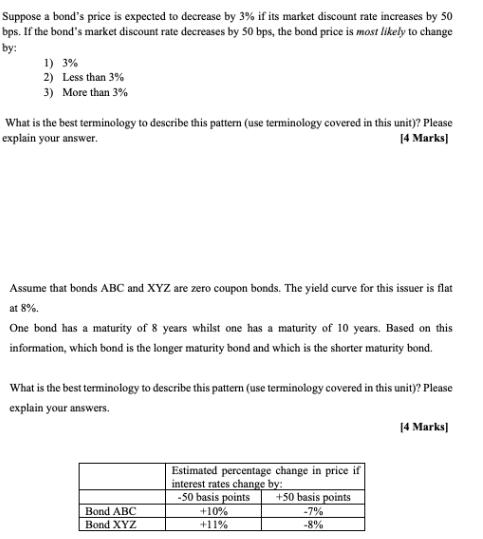

Suppose a bond's price is expected to decrease by 3% if its market discount rate increases by 50 bps. If the bond's market discount rate decreases by 50 bps, the bond price is most likely to change by: 1) 3% 2) Less than 3% 3) More than 3% What is the best terminology to describe this pattern (use terminology covered in this unit)? Please explain your answer. [4 Marks] Assume that bonds ABC and XYZ are zero coupon bonds. The yield curve for this issuer is flat at 8%. One bond has a maturity of 8 years whilst one has a maturity of 10 years. Based on this information, which bond is the longer maturity bond and which is the shorter maturity bond. What is the best terminology to describe this pattern (use terminology covered in this unit)? Please explain your answers. Bond ABC Bond XYZ Estimated percentage change in price if interest rates change by: -50 basis points +50 basis points -7% -8% +10% +11% [4 Marks]

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Bond Price Sensitivity and Interest Rates Question 1 Scenario Bond price expected to decrease by 3 if the market discount rate increases by 50 basis p... View full answer

Get step-by-step solutions from verified subject matter experts