Question: Suppose a client asks you for a valuation analysis on the seven-stock U.S. common stock portfolio given in Table 3-10. The stocks are equally weighted

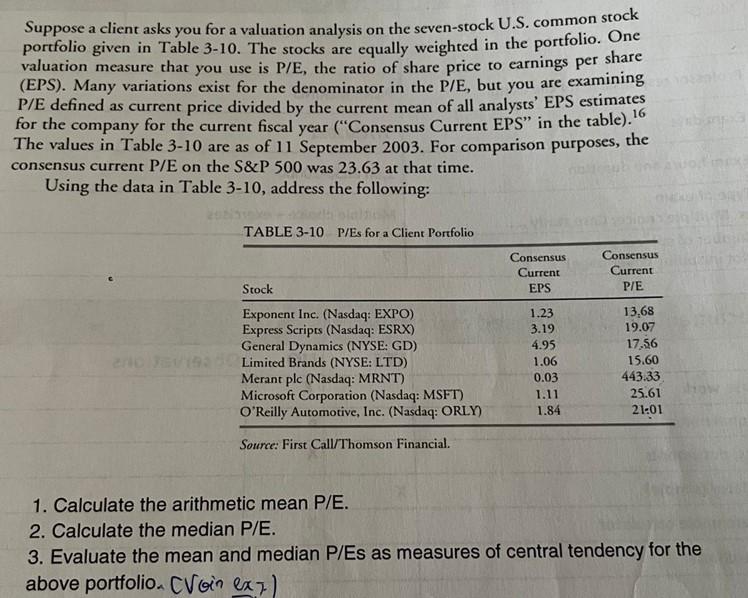

Suppose a client asks you for a valuation analysis on the seven-stock U.S. common stock portfolio given in Table 3-10. The stocks are equally weighted in the portfolio. One valuation measure that you use is P/E, the ratio of share price to earnings per share (EPS). Many variations exist for the denominator in the P/E, but you are examining P/E defined as current price divided by the current mean of all analysts' EPS estimates for the company for the current fiscal year ("Consensus Current EPS" in the table). 16 The values in Table 3-10 are as of 11 September 2003. For comparison purposes, the consensus current P/E on the S\&P 500 was 23.63 at that time. Using the data in Table 3-10, address the following: TABI.F 3-1n D/Fefnraflient Parrfolin Source: First Call/Thomson Financial. 1. Calculate the arithmetic mean P/E. 2. Calculate the median P/E. 3. Evaluate the mean and median P/Es as measures of central tendency for the above portfolio. CV in (x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts