Question: Suppose a computer software developer for a certain company purchased a computer system for $65,000 on April 27, 2017. The computer system is used for

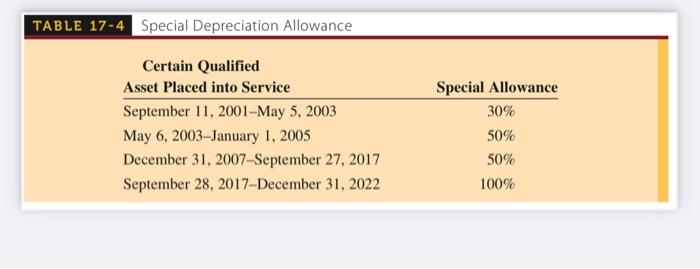

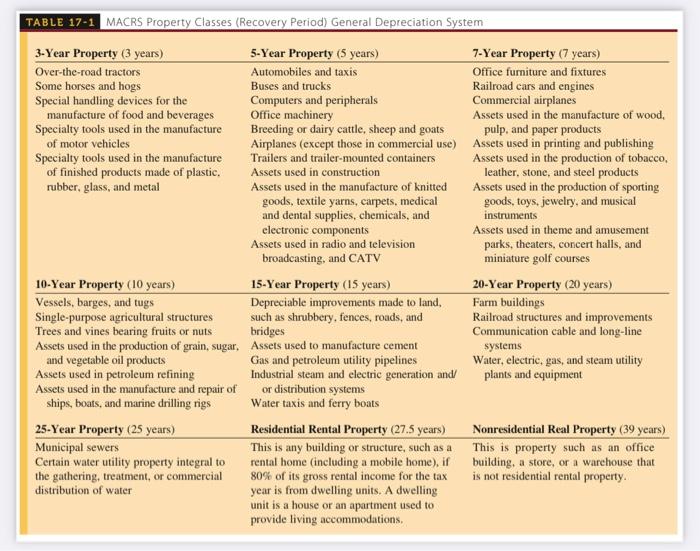

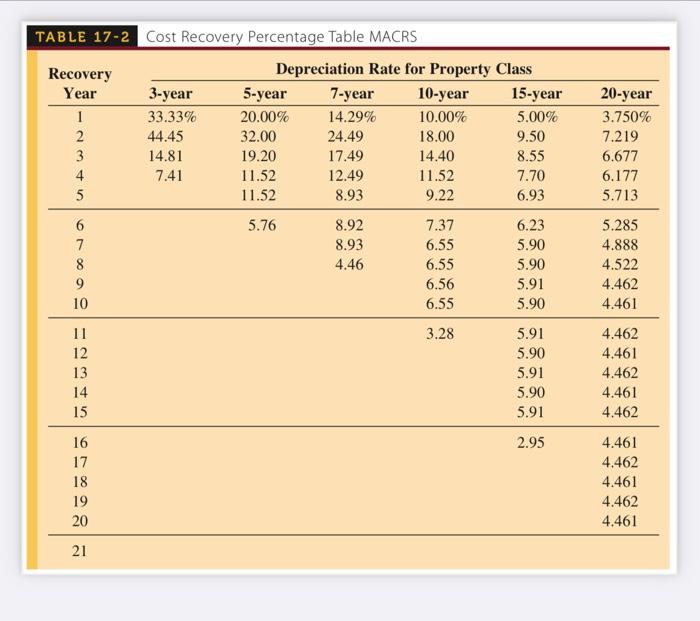

TABLE 17-4 Special Depreciation Allowance \begin{tabular}{lc} \multicolumn{1}{c}{ Certain Qualified } & \\ Asset Placed into Service & Special Allowance \\ \hline September 11, 2001-May 5, 2003 & 30% \\ May 6, 2003-January 1, 2005 & 50% \\ December 31, 2007-September 27, 2017 & 50% \\ September 28, 2017-December 31, 2022 & 100% \end{tabular} \begin{tabular}{|l|ll} TABLE 17-1 MACRS Property Classes (Recovery Period) General Depreciation System \end{tabular} TABLE 17-2 Cost Recovery Percentage Table MACRS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts