Question: Suppose a hedge fund has a net asset value (NAV) of $200 million at the start of the year and realized a gross return of

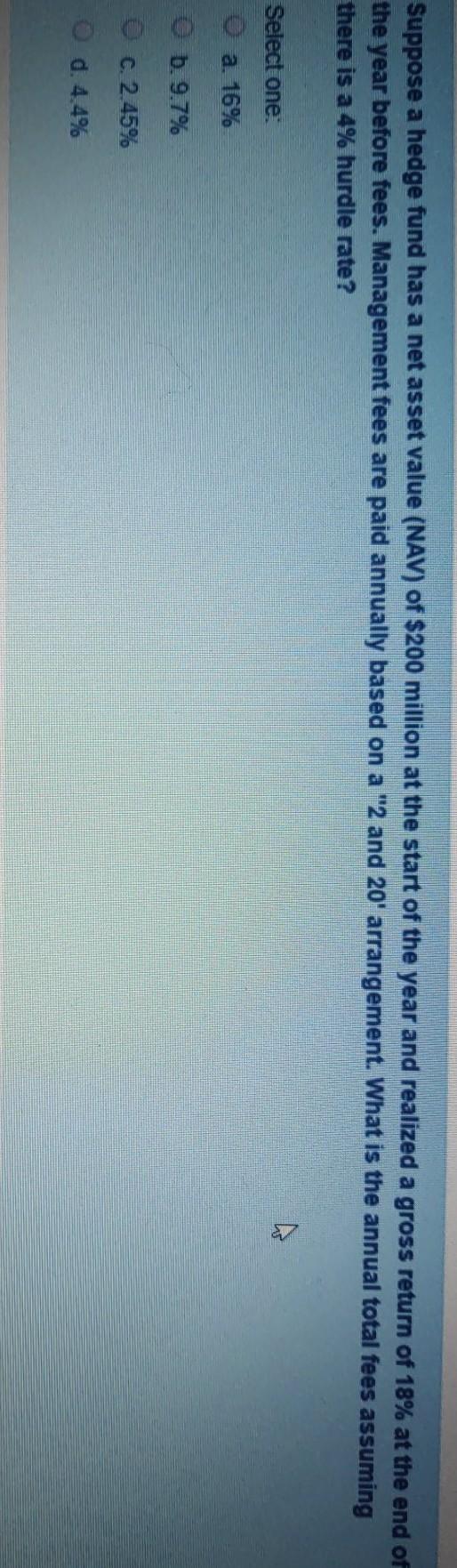

Suppose a hedge fund has a net asset value (NAV) of $200 million at the start of the year and realized a gross return of 18% at the end of the year before fees. Management fees are paid annually based on a "2 and 20' arrangement. What is the annual total fees assuming there is a 4% hurdle rate? Select one: a. 16% 6.9.7% C. 2.45% O d. 4.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts