Question: Suppose a public referendum is being held on whether or not to levy a tax on cigarettes. Currently, the supply of cigarettes is given

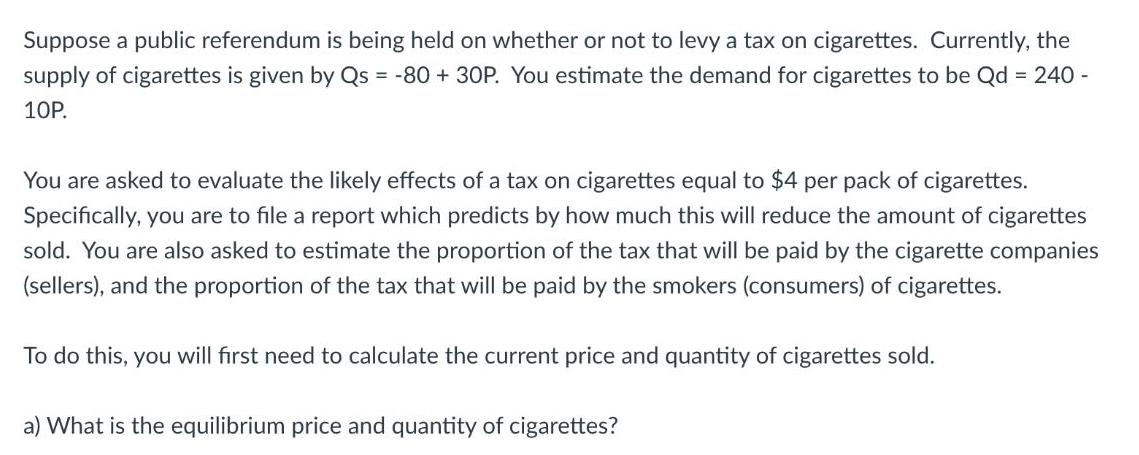

Suppose a public referendum is being held on whether or not to levy a tax on cigarettes. Currently, the supply of cigarettes is given by Qs = -80 + 30P. You estimate the demand for cigarettes to be Qd = 240 - 10P. You are asked to evaluate the likely effects of a tax on cigarettes equal to $4 per pack of cigarettes. Specifically, you are to file a report which predicts by how much this will reduce the amount of cigarettes sold. You are also asked to estimate the proportion of the tax that will be paid by the cigarette companies (sellers), and the proportion of the tax that will be paid by the smokers (consumers) of cigarettes. To do this, you will first need to calculate the current price and quantity of cigarettes sold. a) What is the equilibrium price and quantity of cigarettes? b) What is the price elasticity of demand for cigarettes at the equilibrium price? c) What is the price elasticity of supply of cigarettes at the equilibrium price? Using your answers to b) and c), you are now able to determine what proportion of the tax will be paid by buyers, and what proportion of the tax will be paid by sellers. d) What proportion of the tax will be paid by sellers? e) What price will buyers pay after the tax is imposed? f) How many cigarettes will be sold after the tax?

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

The new price for buyers will be the current price plus the tax New Price is 13 The proportion of th... View full answer

Get step-by-step solutions from verified subject matter experts