Question: Suppose a stock return follows a normal distribution. It has a mean yearly return of 0 . 0 5 . Its return std is 0

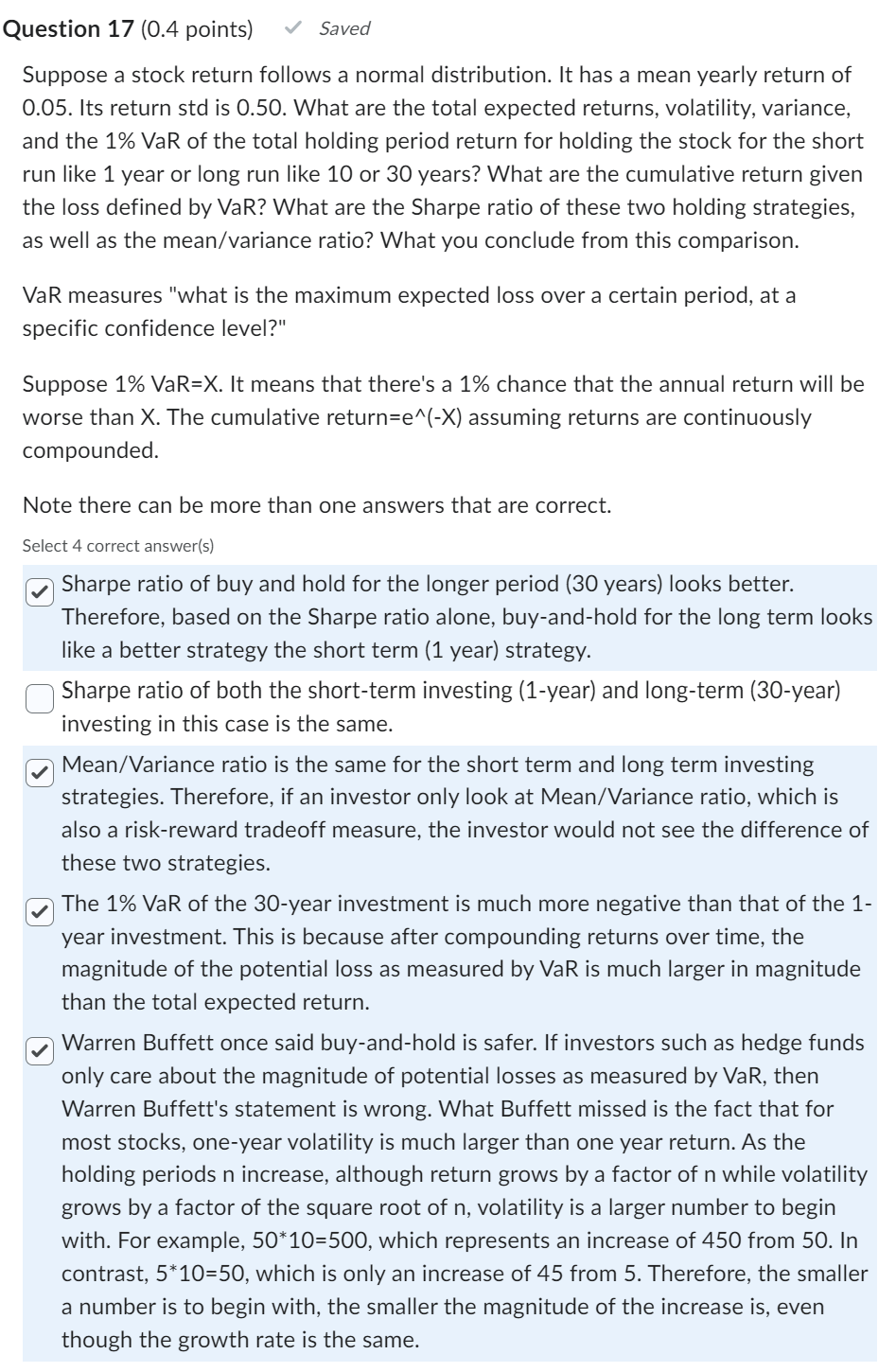

Suppose a stock return follows a normal distribution. It has a mean yearly return of Its return std is What are the total expected returns, volatility, variance, and the mathrmVaR of the total holding period return for holding the stock for the short run like year or long run like or years? What are the cumulative return given the loss defined by VaR? What are the Sharpe ratio of these two holding strategies, as well as the meanvariance ratio? What you conclude from this comparison.

VaR measures "what is the maximum expected loss over a certain period, at a specific confidence level?"

Suppose operatornameVaRX It means that there's a chance that the annual return will be worse than X The cumulative return mathrmewedgemathrmX assuming returns are continuously compounded.

Note there can be more than one answers that are correct.

Select correct answers

Sharpe ratio of buy and hold for the longer period years looks better.

Therefore, based on the Sharpe ratio alone, buyandhold for the long term looks like a better strategy the short term year strategy.

Sharpe ratio of both the shortterm investing year and longterm year investing in this case is the same.

MeanVariance ratio is the same for the short term and long term investing strategies. Therefore, if an investor only look at MeanVariance ratio, which is also a riskreward tradeoff measure, the investor would not see the difference of these two strategies.

The mathrmVaR of the year investment is much more negative than that of the year investment. This is because after compounding returns over time, the magnitude of the potential loss as measured by VaR is much larger in magnitude than the total expected return.

Warren Buffett once said buyandhold is safer. If investors such as hedge funds only care about the magnitude of potential losses as measured by VaR, then Warren Buffett's statement is wrong. What Buffett missed is the fact that for most stocks, oneyear volatility is much larger than one year return. As the holding periods n increase, although return grows by a factor of n while volatility grows by a factor of the square root of n volatility is a larger number to begin with. For example, which represents an increase of from In contrast, which is only an increase of from Therefore, the smaller a number is to begin with, the smaller the magnitude of the increase is even though the growth rate is the same.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock