Question: Suppose a trader does not expect the security prices for an asset to be very volatile in the future. She would like to create an

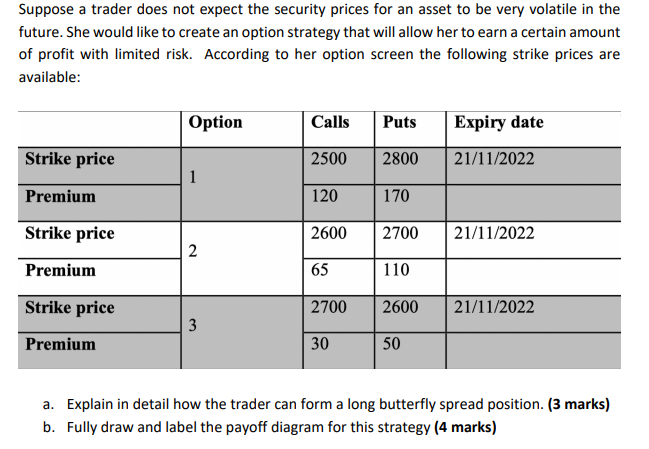

Suppose a trader does not expect the security prices for an asset to be very volatile in the future. She would like to create an option strategy that will allow her to earn a certain amount of profit with limited risk. According to her option screen the following strike prices are available: Option Calls Puts Expiry date Strike price 2500 2800 21/11/2022 1 Premium 120 170 Strike price 2600 2700 21/11/2022 2 Premium 65 110 Strike price 2700 2600 21/11/2022 3 Premium 30 50 a. Explain in detail how the trader can form a long butterfly spread position. (3 marks) b. Fully draw and label the payoff diagram for this strategy (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts