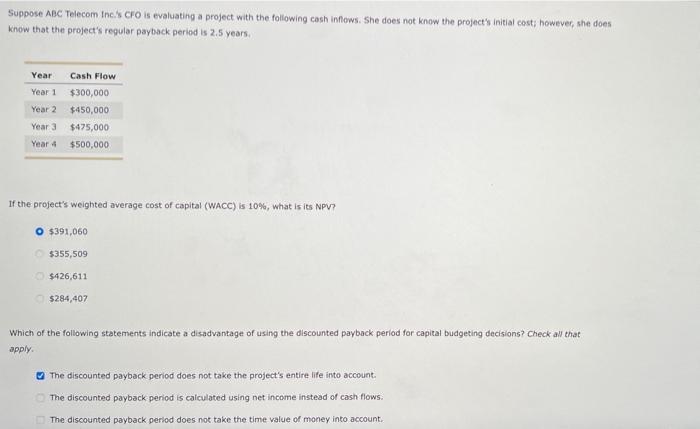

Question: Suppose ABC Telecom Inc.'s CFO is evaluating a project with the following cosh inflows. She does not know the project's initial cost; howeyer, she does

Suppose ABC Telecom Inc.'s CFO is evaluating a project with the following cosh inflows. She does not know the project's initial cost; howeyer, she does know that the project's reqular payback period is 2.5 years. If the project's weighted average cost of capital (WACC) is 10%, what is its NPV? $391,060$355,509$426,611$284,407 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply; The discounted payback period does not take the project's entire life into account. The discounted payback period is calculated using net income instead of cash flows: The discounted payback perlod does not take the time value of money into account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts