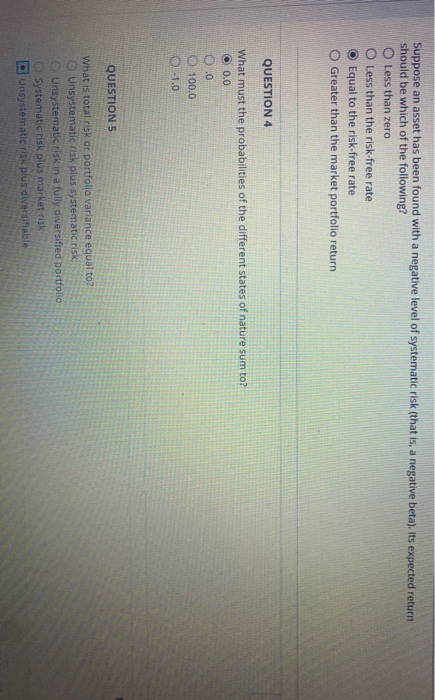

Question: Suppose an asset has been found with a negative level of systematic risk (that is, a negative beta). Its expected return should be which of

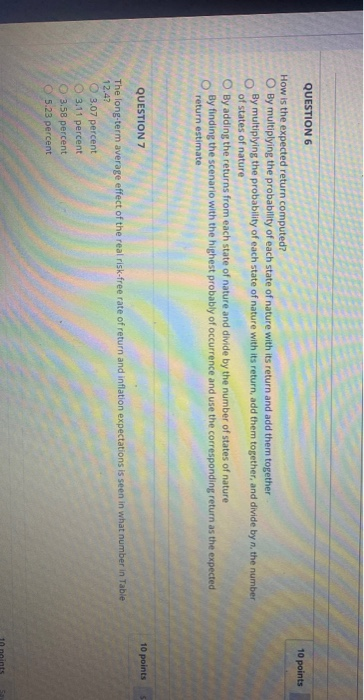

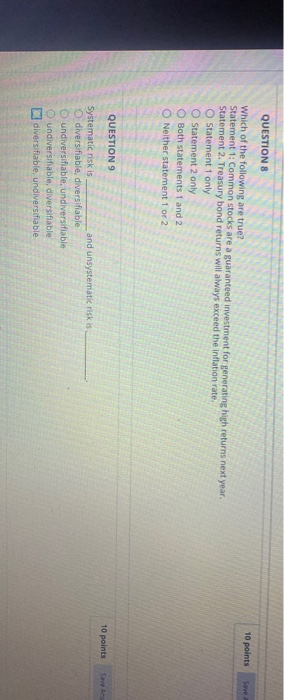

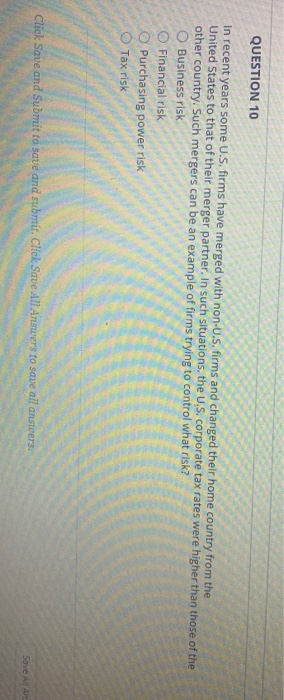

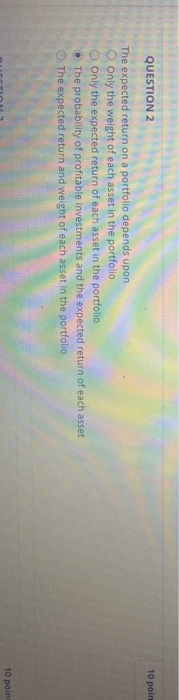

Suppose an asset has been found with a negative level of systematic risk (that is, a negative beta). Its expected return should be which of the following? O Less than zero O Less than the risk-free rate O Equal to the risk-free rate O Greater than the market portfolio return QUESTION 4 What must the probabilities of the different states of nature sum to? O 0.0 0 .0 100.0 -1.0 QUESTION 5 What is total risk or portfolio variance equal to? Unsystematic risk plus systematic risk Unsystematic risk in a fully diversified portfolio Systematic risk plus market risk Unsystematic risk plus diversifiable QUESTION 6 10 points O multiplying th How is the expected return computed? O By multiplying the probability of each state of nature with its return and add them together By multiplying the probability of each state of nature with its return, add them together, and divide by n, the number of states of nature O By adding the returns from each state of nature and divide by the number of states of nature By finding the scenario with the highest probably of occurrence and use the corresponding return as the expected 0 return estimate 10 points 5 STION QUESTION 7 The long-term average effect of the real risk-free rate of return and inflation expectations is seen in what number in Table 12,42 3.07 percent 3.11 percent 3.58 percent 5.23 percent 10 naints 5 QUESTIONS 10 points Save Which of the following are true? Statement 1: Common stocks are a guaranteed investment for generating high returns next year Statement 2. Treasury bond returns will always exceed the inflation rate. Statement only Statement 2 only O Both statements 1 and 2 Neither statement 1 or 2 10 points Save As QUESTIONS Systematic riskis and unsystematic risk O diversifiable, diversifiable undiversifiable, undiversifiable undiversifiable, diversifiable diversifiable, undiversifiable QUESTION 10 In recent years some U.S. firms have merged with non-U.S. firms and changed their home country from the United States to that of their merger partner. In such situations, the U.S. corporate tax rates were higher than those of the other country. Such mergers can be an example of firms trying to control what risk? Business risk O Financial risk Purchasing power risk Tax risk Click Save and Subrrut to save and submit. Click Save All Answers to save all answers. Save All An 10 poin QUESTION 2 The expected return on a portfolio depends upon Only the weight of each asset in the portfolio Only the expected return of each asset in the portfolio The probability of profitable investments and the expected return of each asset The expected return and weight of each asset in the portfolio 10 poin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts