Question: Suppose Bon Temps is expected to experience zero growth during the first 3 years and then resume its steady-state growth of 4% in the fourth

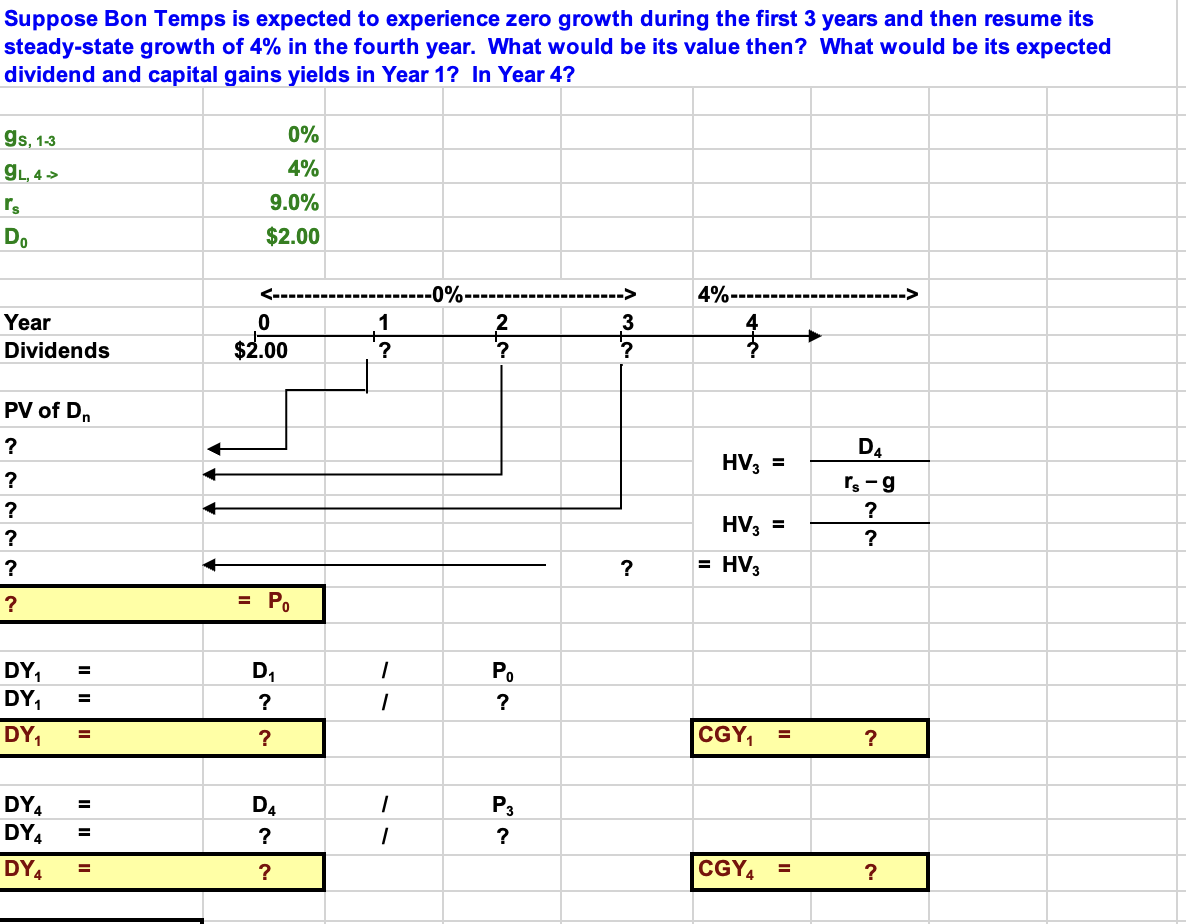

Suppose Bon Temps is expected to experience zero growth during the first 3 years and then resume its steady-state growth of 4% in the fourth year. What would be its value then? What would be its expected dividend and capital gains yields in Year 1? In Year 4? gs, 1-3 0% 92,4-> 4% 9.0% $2.00 D. -0% 4% 0 Year Dividends $2.00 1 ? 2 ? ON 3 ? 4 PV of Dn ? HV ? ? ? D4 rs -g ? ? HV3 = ? ? = HV3 ? = PO = DY DY, DY D ? P. ? = = ? CGY = ? DY4 = 1 D4 ? P3 ? DY = / DY4 = ? CGY4 = ? Suppose Bon Temps is expected to experience zero growth during the first 3 years and then resume its steady-state growth of 4% in the fourth year. What would be its value then? What would be its expected dividend and capital gains yields in Year 1? In Year 4? gs, 1-3 0% 92,4-> 4% 9.0% $2.00 D. -0% 4% 0 Year Dividends $2.00 1 ? 2 ? ON 3 ? 4 PV of Dn ? HV ? ? ? D4 rs -g ? ? HV3 = ? ? = HV3 ? = PO = DY DY, DY D ? P. ? = = ? CGY = ? DY4 = 1 D4 ? P3 ? DY = / DY4 = ? CGY4 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts