Question: Suppose Bond A has a face value worth $1000. It pays a coupon on a semi-annual basis, and the annual coupon rate is 8%

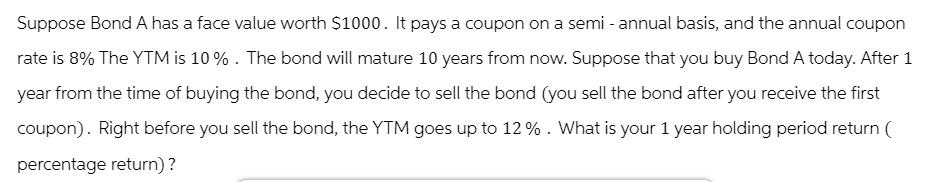

Suppose Bond A has a face value worth $1000. It pays a coupon on a semi-annual basis, and the annual coupon rate is 8% The YTM is 10%. The bond will mature 10 years from now. Suppose that you buy Bond A today. After 1 year from the time of buying the bond, you decide to sell the bond (you sell the bond after you receive the first coupon). Right before you sell the bond, the YTM goes up to 12%. What is your 1 year holding period return ( percentage return)?

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

To calculate the oneyear holding period return HPR for Bond A we need to consider the coupon payments received and the change in bond price due to the change in yield to maturity YTM First lets calculate the coupon payments received during the oneyear holding period Bond A has a face value of 1000 and a semiannual coupon rate of 8 Therefore the coupon payment ... View full answer

Get step-by-step solutions from verified subject matter experts