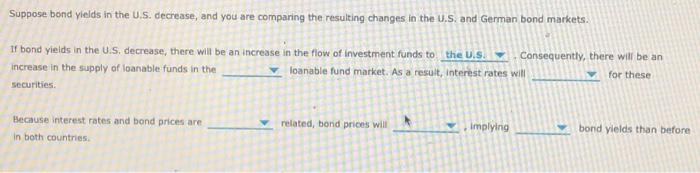

Question: Suppose bond yields in the U.S. decrease, and you are comparing the resulting changes in the U.S. and German bond markets. If bond yields in

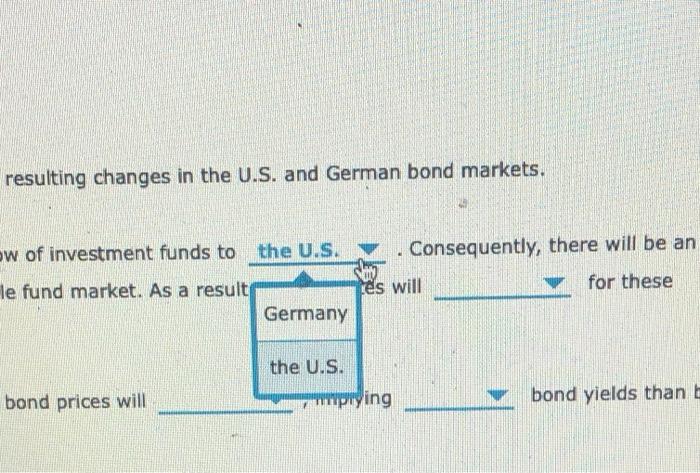

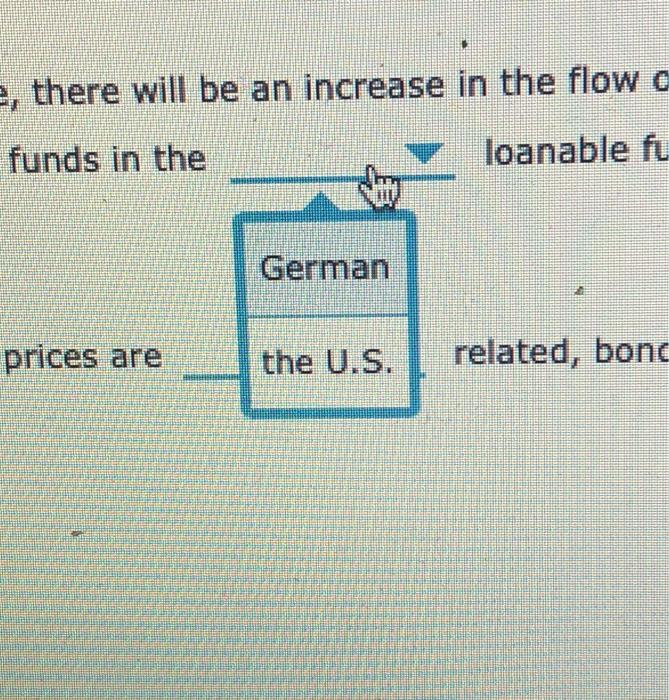

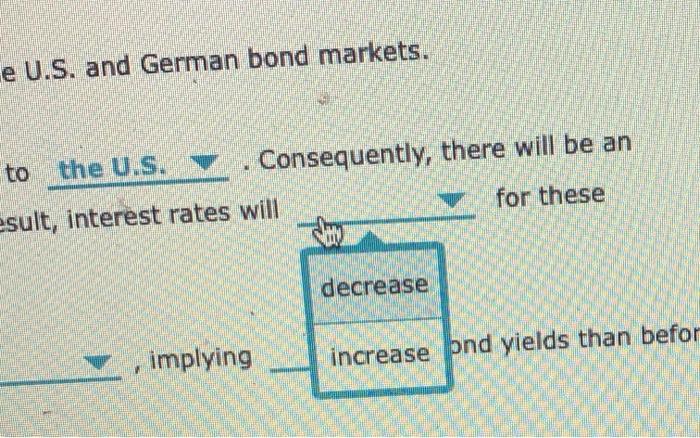

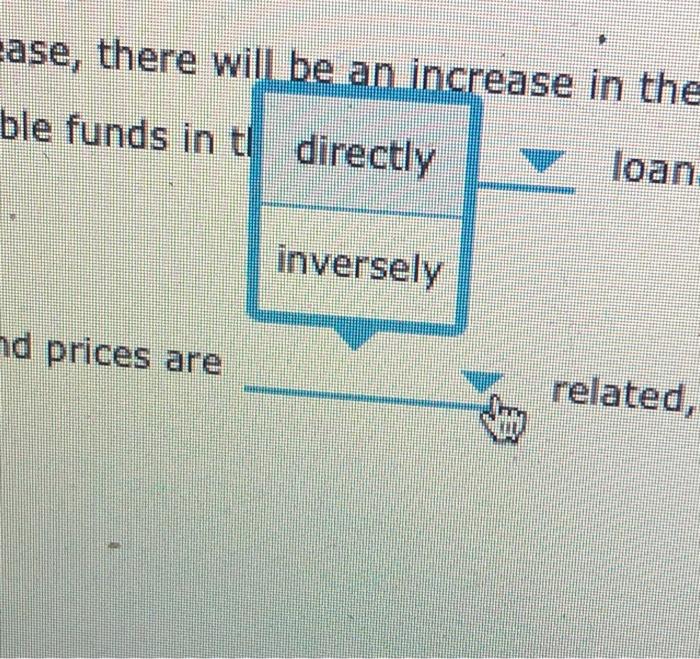

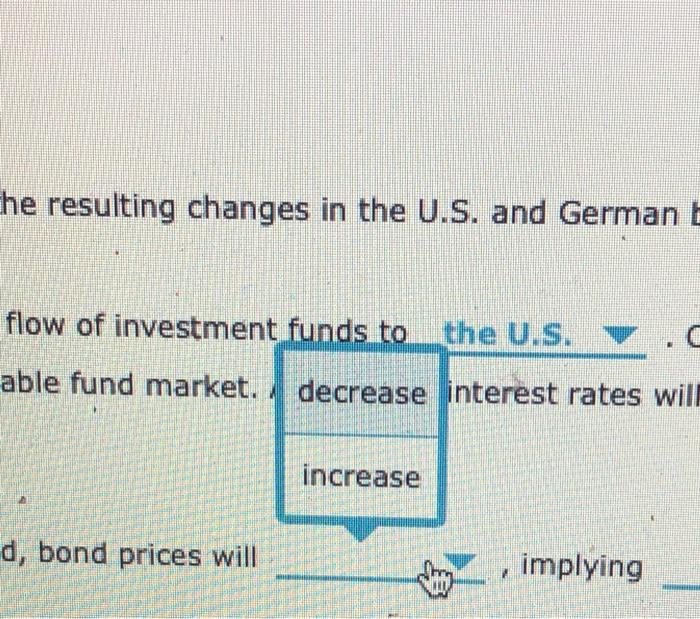

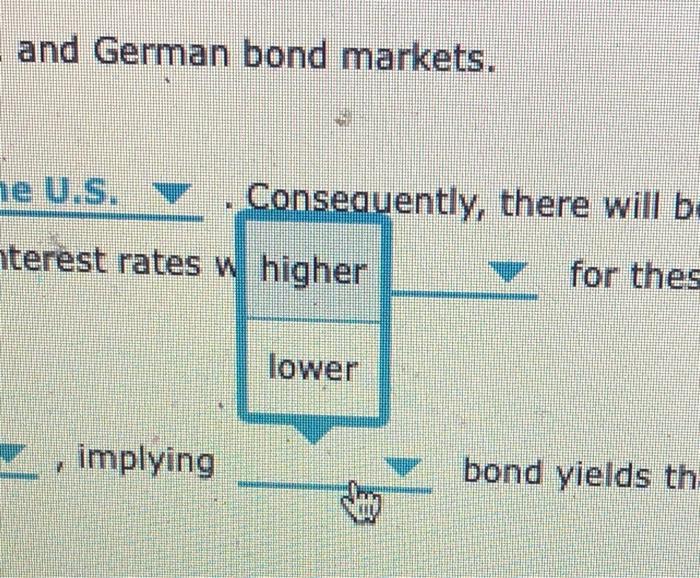

Suppose bond yields in the U.S. decrease, and you are comparing the resulting changes in the U.S. and German bond markets. If bond yields in the U.S. decrease, there will be an increase in the flow of investment funds to the U.S. Consequently, there will be an increase in the supply of Ioanable funds in the Ioanable fund market. As a result, interest rates will for these securities Because interest rates and bond prices are in both countries related, bond prices will implying bond yields than before resulting changes in the U.S. and German bond markets. w of investment funds to the U.S. . Consequently, there will be an le fund market. As a result tes will for these Germany the U.S. prying bond prices will bond yields than b e, there will be an increase in the flow o funds in the loanable fi German prices are the U.S. related, bond e U.S. and German bond markets. to the U.S. V. Consequently, there will be an esult, interest rates will for these decrease implying increase pnd yields than befor case, there will be an increase in the ble funds in tl directly loan inversely nd prices are related he resulting changes in the U.S. and German E flow of investment funds to the U.S. able fund market. decrease interest rates will increase d, bond prices will they implying and German bond markets. ne U.S. Y . Consequently, there will b be nterest rates w higher for thes lower implying bond yields th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts