Question: Suppose call prices are given by 1 0 2 0 3 0 StrikePrice ( $ ) Call Premium ( $ ) 5 4 2 What

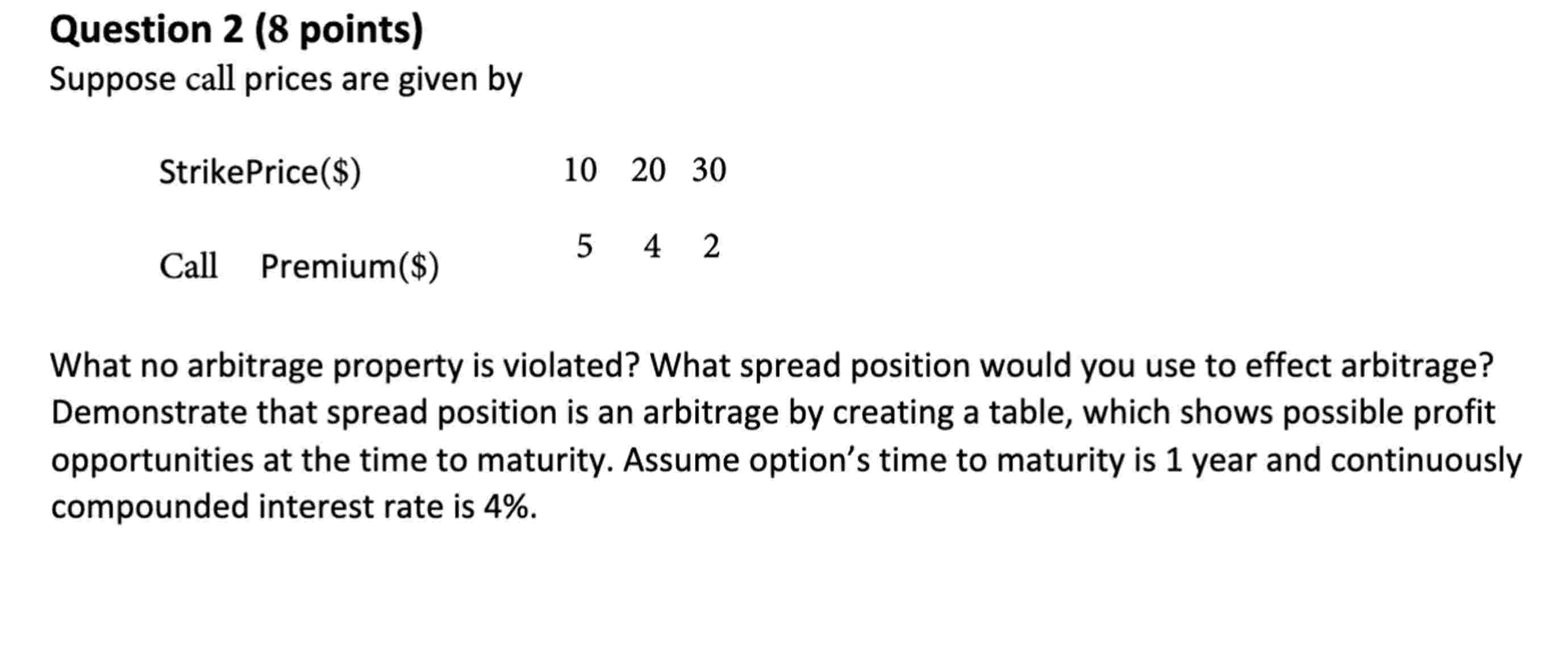

Suppose call prices are given by StrikePrice$ Call Premium$ What no arbitrage property is violated? What spread position would you use to effect arbitrage? Demonstrate that spread position is an arbitrage by creating a table, which shows possible profit opportunities at the time to maturity. Assume options time to maturity is year and continuously compounded interest rate is Question points

Suppose call prices are given by

What no arbitrage property is violated? What spread position would you use to effect arbitrage? Demonstrate that spread position is an arbitrage by creating a table, which shows possible profit opportunities at the time to maturity. Assume option's time to maturity is year and continuously compounded interest rate is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock