Question: Suppose Captain Kirk is compensated based on Operating Income, calculated as revenues from his space trading activity net of COGS. Which offer will Kirk accept,

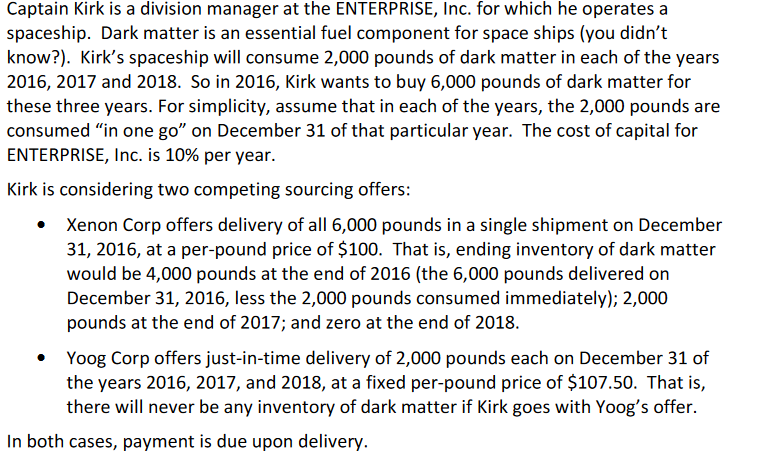

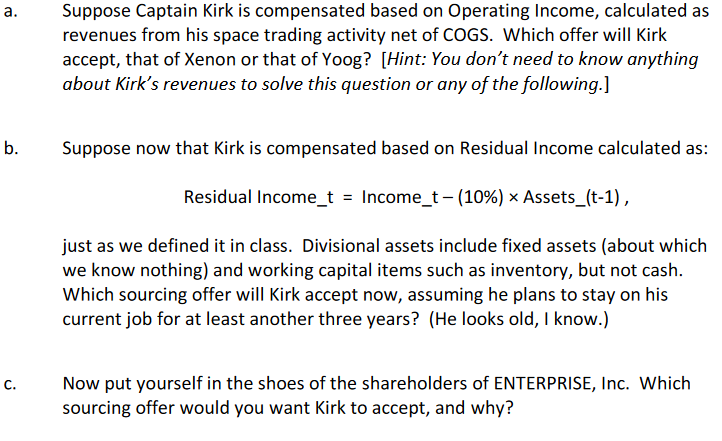

Suppose Captain Kirk is compensated based on Operating Income, calculated as revenues from his space trading activity net of COGS. Which offer will Kirk accept, that of Xenon or that of Yoog? [Hint: You don't need to know anything about Kirk's revenues to solve this question or any of the following.] a. b. Suppose now that Kirk is compensated based on Residual Income calculated as: Residual income-t- income-t-(1096) x Assets(t-1) just as we defined it in class. Divisional assets include fixed assets (about which we know nothing) and working capital items such as inventory, but not cash Which sourcing offer will Kirk accept now, assuming he plans to stay on his current job for at least another three years? (He looks old, I know.) c. Now put yourself in the shoes of the shareholders of ENTERPRISE, Inc. Which sourcing offer would you want Kirk to accept, and why? Suppose Captain Kirk is compensated based on Operating Income, calculated as revenues from his space trading activity net of COGS. Which offer will Kirk accept, that of Xenon or that of Yoog? [Hint: You don't need to know anything about Kirk's revenues to solve this question or any of the following.] a. b. Suppose now that Kirk is compensated based on Residual Income calculated as: Residual income-t- income-t-(1096) x Assets(t-1) just as we defined it in class. Divisional assets include fixed assets (about which we know nothing) and working capital items such as inventory, but not cash Which sourcing offer will Kirk accept now, assuming he plans to stay on his current job for at least another three years? (He looks old, I know.) c. Now put yourself in the shoes of the shareholders of ENTERPRISE, Inc. Which sourcing offer would you want Kirk to accept, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts