Question: Suppose Charles contributed ( $ 5 0 , 0 0 0 ) in cash, and a building with a fair market value

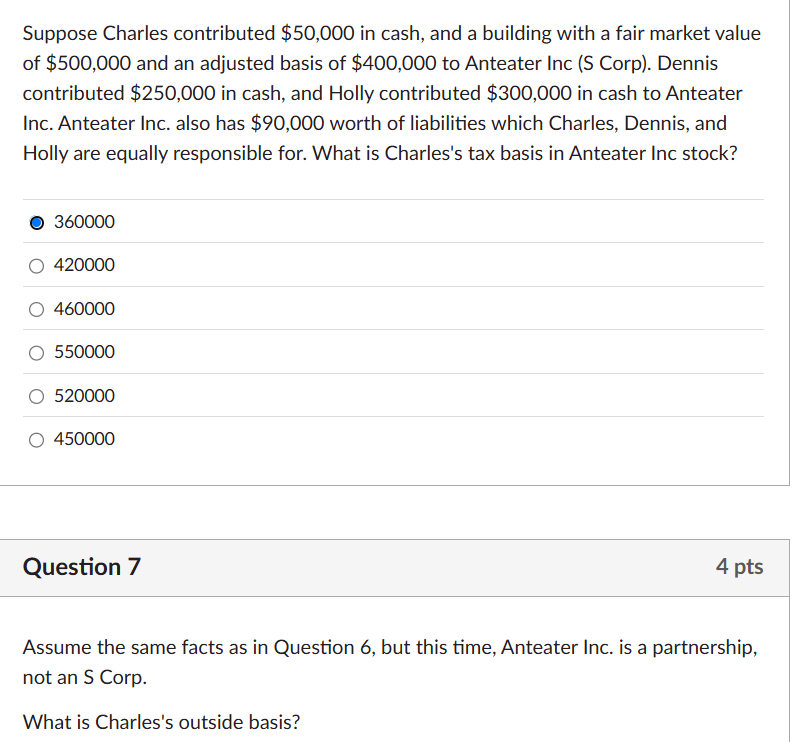

Suppose Charles contributed $ in cash, and a building with a fair market value of $ and an adjusted basis of $ to Anteater Inc S Corp Dennis contributed $ in cash, and Holly contributed $ in cash to Anteater Inc. Anteater Inc. also has $ worth of liabilities which Charles, Dennis, and Holly are equally responsible for. What is Charles's tax basis in Anteater Inc stock?

Question

Assume the same facts as in Question but this time, Anteater Inc. is a partnership, not an S Corp.

What is Charles's outside basis?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock