Question: Suppose Clorox can lease a new computer data processing system for $972,000 per year for five years. Alternatively, it can purchase the system for $4.25

-

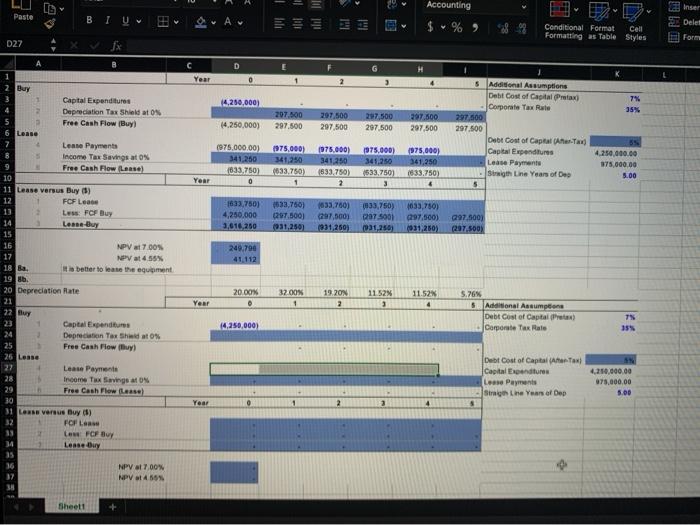

If Clorox will depreciate the computer equipment on a straight-line basis over the next five years, and if the lease qualifies as a true tax lease, is it better to lease or finance the purchase of the equipment?

-

Suppose that if Clorox buys the equipment, it will use accelerated depreciation for tax purposes. Specifically, suppose it can expense 20% of the purchase price immediately and can take depreciation deductions equal to 32%, 19.2%, 11.52%, 11.52%, and 5.76% of the purchase price over the next five years. Compare leasing with purchase in this case.

Suppose Clorox can lease a new computer data processing system for $972,000 per year for five years. Alternatively, it can purchase the system for $4.25 million. Assume Clorox has a borrowing cost of 6.6% and a tax rate of 35%, and the system will be obsolete at the end of five years.

Part A is done I just need to know how to calculate part B (preferrably on excel)

Accounting Inser Paste BIUDA Delet Conditional Format Cell Formatting as Table Styles Form D27 G Year 1 4 14,250,000) 7% 35% (4.250,000) 207.000 297.500 297.500 297.500 27,500 297,500 297,500 297.500 Buy Capital Expenditures Depreciation Tax Shield at 0 2 Free Cash Flow Buy Lease Leane Payments Income Tax Savings at 0% Free Cash Flow Lease) 10 11 Lease versus Buy ) 12 FCF Lee 1 LES FCF Buy 14 Lesse-Buy 5 Additional Assumptions Debt Cost of Capital Prax) Corporate Tax Rate 297.500 297.500 Debt Cost of Captates Capital Expenditures Lease Payments Strigth Line Years of De (975.000,00) 341.250 1033.750) Year 1975,000) 341.250 633.750) 1 1975.000) 341.250 1833.750) 1975.000) 345.250 1533,750) 3 1975,000) 341,250 (633.750) & 4.250,000.00 175,000.00 3.00 2 1633.750) 4,250.000 3,616,250 633,760) 297.500) 1633.7601 297,500 1931,250) 1935,750) 207 5001 (31,250) 1033,780) 097,500) (531,250) 097.500) (297.500 249.796 41,112 NPV at 7.00 17 NPV at 4.55% 18 Ba. It is better to beat the equipment 19 Sb. 20 Depreciation Rate 20.00% 32.00% 1 19.20N 2 11.52% 2 11.52% 4 Year 5.76% 5 Additional Assumption Debt Cost of Captain) Comorate Tax Rate TS 14,250,000) 22 Buy Capital Expenditures Depreciation Tax Shiato Free Cash Flow flyi 26 Lease 27 Lease Payment 28 Income Tax Savings as 29 Free Cash Flow lease) 30 31 Lesse versus Buy ) FCF Les 13 Low FCF Buy Lease Buy 35 NPV at 7.00% NPV 4553 Debt Cost of Capitale Taxi Capital Expenditures Lease Payments Strone Years of Dep 4.210,000.00 075,000.00 Year 0 1 2 3 4 Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts