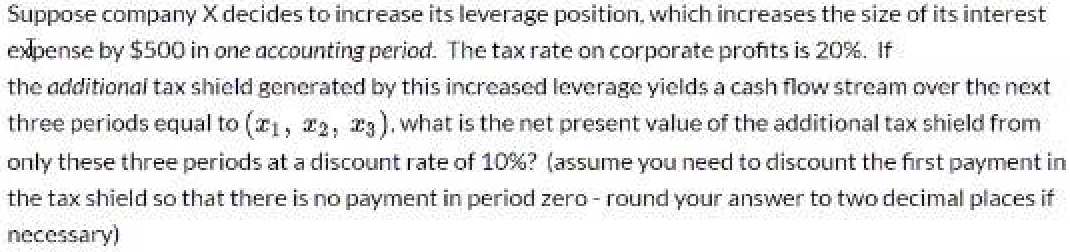

Question: Suppose company Xdecides to increase its leverage position, which increases the size of its interest expense by $500 in one accounting period. The tax rate

Suppose company Xdecides to increase its leverage position, which increases the size of its interest expense by $500 in one accounting period. The tax rate on corporate profits is 20%. If the additionai tax shield generated by this increased leverage yields a cash flow stream over the next three periods equal to (C1, 12, 23). what is the net present value of the additional tax shield from only these three periods at a discount rate of 10%? (assume you need to discount the first payment in the tax shield so that there is no payment in period zero-round your answer to two decimal places if necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts