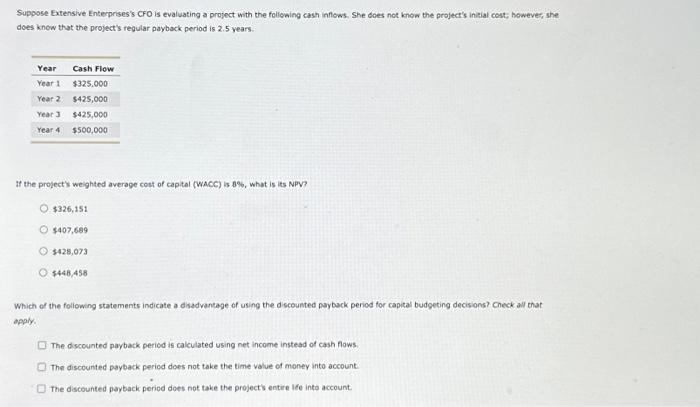

Question: Suppose Extensive Enterprises's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know

Suppose Extensive Enterprises's CFO is evaluating a project with the follewing cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. It the project's weighted average cost of capital (WACC) is 0\%, what is its NPV? $326,151 $407,689 $428,073 $448,458 Which of the foliowing statements indicate a disdvantage of using the discounted payback period for capizal budgeting decisions? Check all that apaly. The dscounted payback period is calculated using net income instead of cash flows. The discounted payback pericd does not take the time value of moner into account. The discounted payback period does not take the projects entire lfe into account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts