Question: Suppose initially that two assets, A and B, will each make a single guaranteed payment of $100 in one year. But asset A has

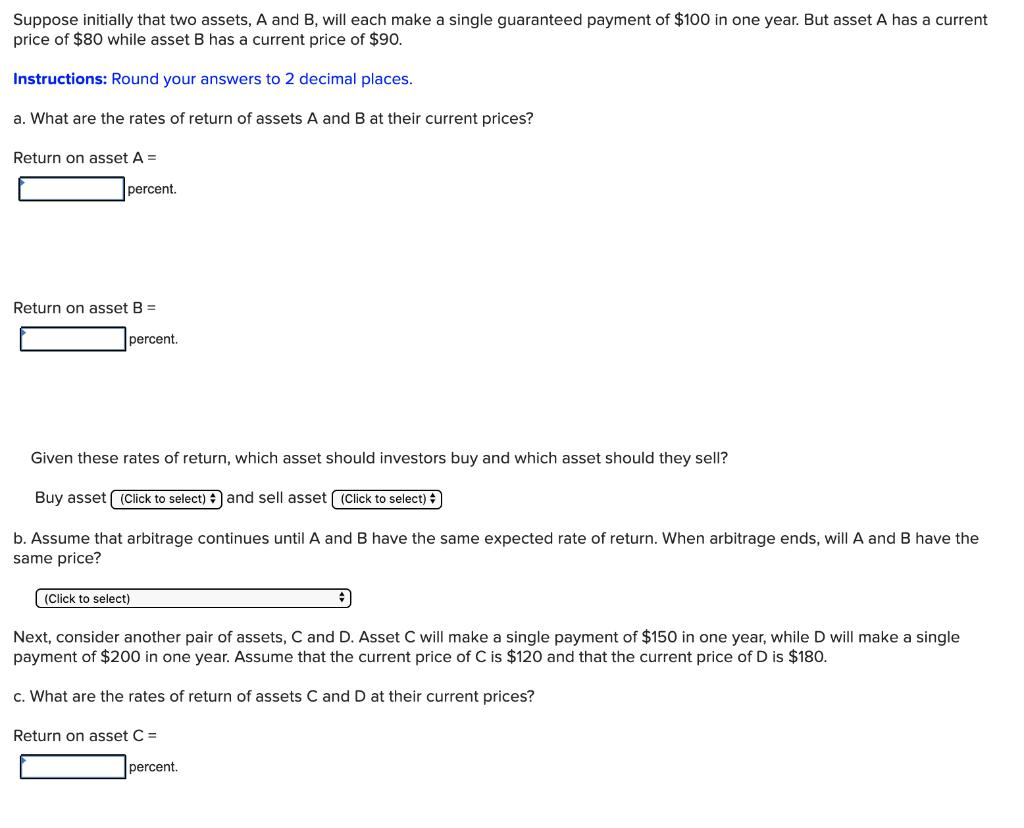

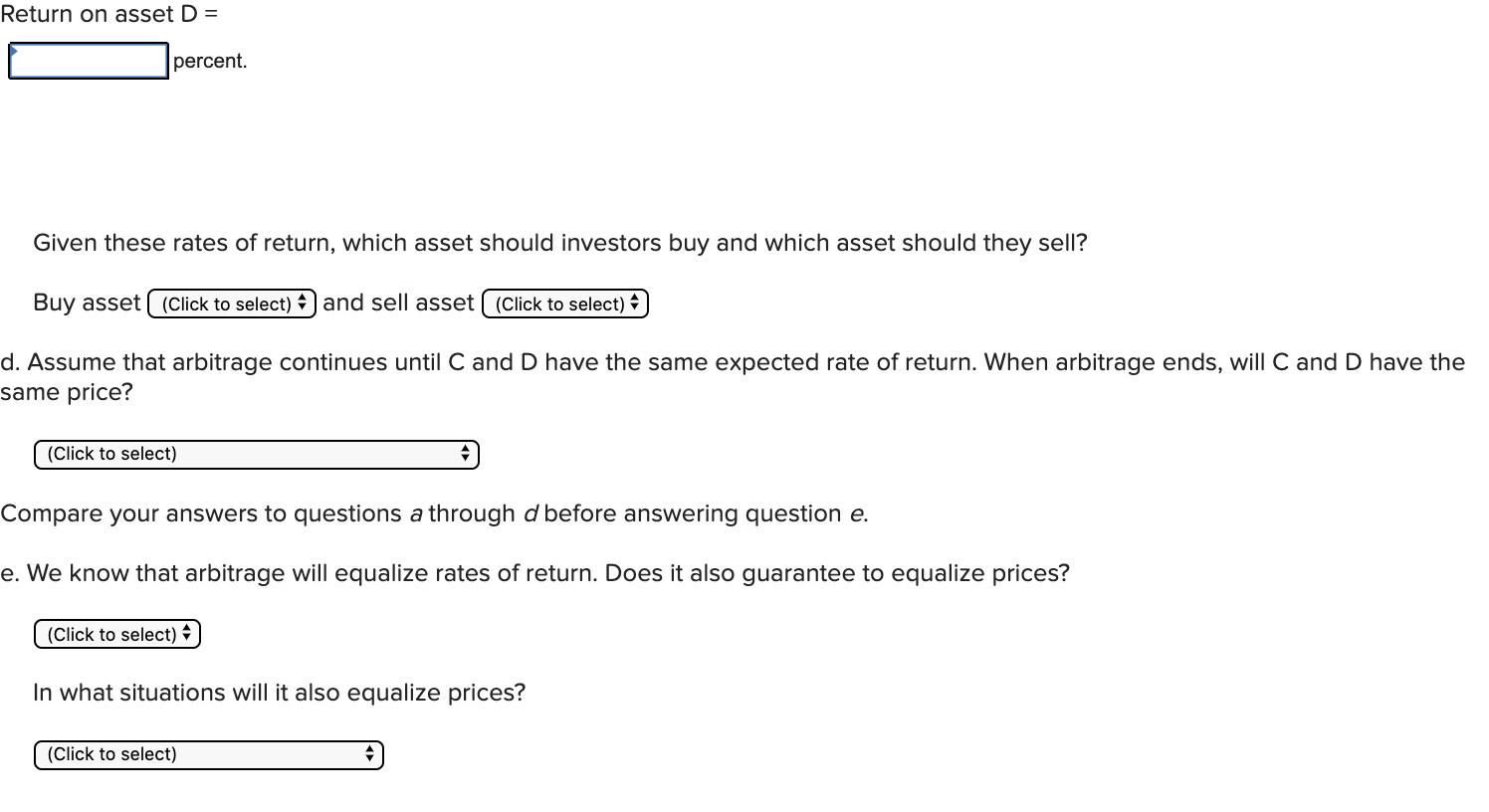

Suppose initially that two assets, A and B, will each make a single guaranteed payment of $100 in one year. But asset A has a current price of $80 while asset B has a current price of $90. Instructions: Round your answers to 2 decimal places. a. What are the rates of return of assets A and B at their current prices? Return on asset A = percent. Return on asset B = percent. Given these rates of return, which asset should investors buy and which asset should they sell? Buy asset (Click to select) + and sell asset (Click to select) : b. Assume that arbitrage continues until A and B have the same expected rate of return. When arbitrage ends, will A and B have the same price? (Click to select) Next, consider another pair of assets, C and D. Asset C will make a single payment of $150 in one year, while D will make a single payment of $200 in one year. Assume that the current price of C is $120 and that the current price of D is $180. c. What are the rates of return of assets C and D at their current prices? Return on asset C = percent. Return on asset D = percent. Given these rates of return, which asset should investors buy and which asset should they sell? Buy asset ( (Click to select) ) and sell asset ( (Click to select) + d. Assume that arbitrage continues until C and D have the same expected rate of return. When arbitrage ends, will C and D have the same price? (Click to select) Compare your answers to questions a through d before answering question e. e. We know that arbitrage will equalize rates of return. Does it also guarantee to equalize prices? (Click to select) In what situations will it also equalize prices? (Click to select)

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

a Rate of return on asset ... View full answer

Get step-by-step solutions from verified subject matter experts