Question: Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here with a correlation of 19% Calculate the expected return and

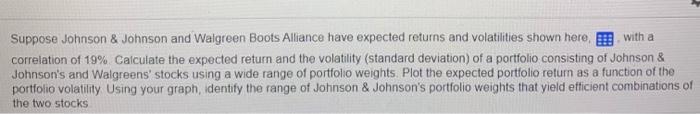

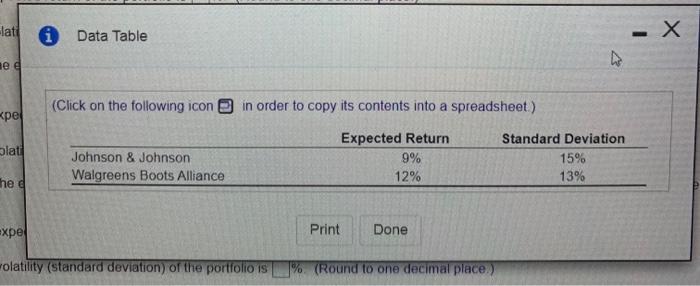

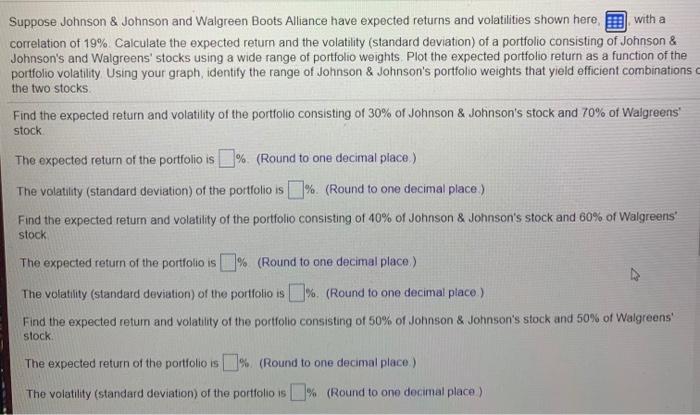

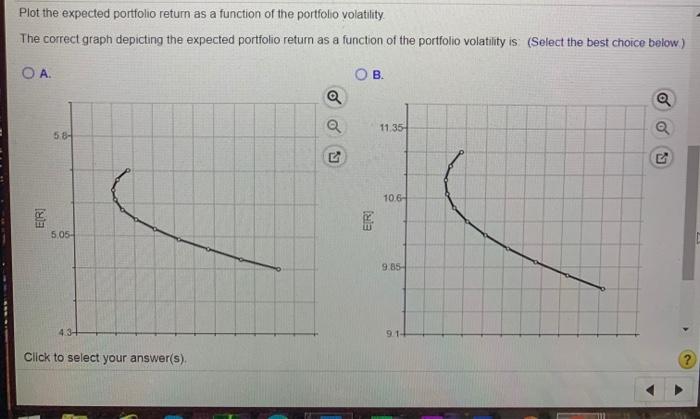

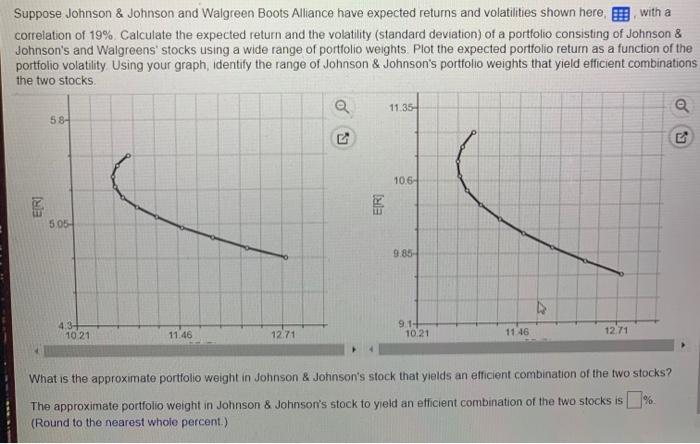

Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here with a correlation of 19% Calculate the expected return and the volatility (standard deviation) of a portfolio consisting of Johnson & Johnson's and Walgreens' stocks using a wide range of portfolio weights. Plot the expected portfolio return as a function of the portfolio volatility Using your graph, identify the range of Johnson & Johnson's portfolio weights that yield efficient combinations of the two stocks lati Data Table - X lee (Click on the following icon in order to copy its contents into a spreadsheet) Standard Deviation olati Johnson & Johnson Walgreens Boots Alliance Expected Return 9% 12% 15% 13% he xpel Print Done wolatility (Standard deviation) of the portfolio is % (Round to one decimal place) with a Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here correlation of 19% Calculate the expected return and the volatility (standard deviation) of a portfolio consisting of Johnson & Johnson's and Walgreens' stocks using a wide range of portfolio weights Plot the expected portfolio return as a function of the portfolio volatility Using your graph, identify the range of Johnson & Johnson's portfolio weights that yield officient combinations the two stocks Find the expected return and volatility of the portfolio consisting of 30% of Johnson & Johnson's stock and 70% of Walgreens stock The expected return of the portfolio is % (Round to one decimal place) The volatility (standard deviation) of the portfolio is % (Round to one decimal place) Find the expected return and volatility of the portfolio consisting of 40% of Johnson & Johnson's stock and 60% of Walgreens stock The expected return of the portfolio is % (Round to one decimal place) The volatility (standard deviation) of the portfolio is 3% (Round to one decimal place) Find the expected return and volatility of the portfolio consisting of 50% of Johnson & Johnson's stock and 50% of Walgreens stock The expected return of the portfolio is % (Round to one decimal place) The volatility (standard deviation) of the portfolios % (Round to one decimal place) Plot the expected portfolio return as a function of the portfolio volatility The correct graph depicting the expected portfolio return as a function of the portfolio volatility is (Select the best choice below) . B. Q a a 11.35 58- S 10.6 ER ER 505- 9.85 91- Click to select your answer(s). Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here, with a correlation of 19% Calculate the expected return and the volatility (standard deviation) of a portfolio consisting of Johnson & Johnson's and Walgreens' stocks using a wide range of portfolio weights. Plot the expected portfolio return as a function of the portfolio volatility Using your graph, identify the range of Johnson & Johnson's portfolio weights that yield efficient combinations the two stocks Q 11.35 @ 58- ES 106 E[RI EIR 505 9.85- > 434 1021 11:46 9.1 10.21 1271 1271 11 46 What is the approximate portfolio weight in Johnson & Johnson's stock that yields an efficient combination of the two stocks? The approximate portfolio weight in Johnson & Johnson's stock to yield an efficient combination of the two stocks is % (Round to the nearest whole percent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts