Question: Suppose Ruby bought an income-producing property that is expected to yield cash flows of $115,000 in years one through three and $185,000 in years four

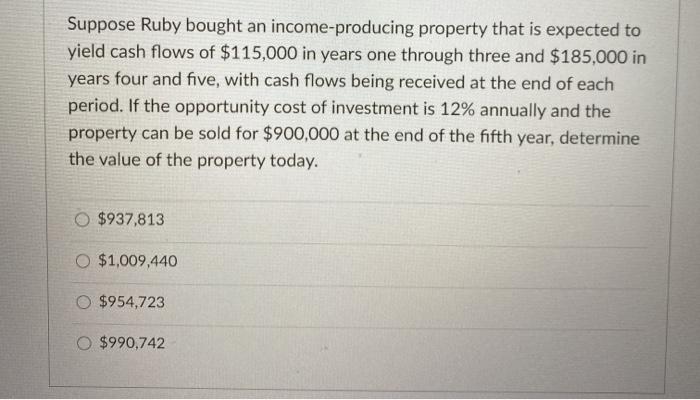

Suppose Ruby bought an income-producing property that is expected to yield cash flows of $115,000 in years one through three and $185,000 in years four and five, with cash flows being received at the end of each period. If the opportunity cost of investment is 12% annually and the property can be sold for $900,000 at the end of the fifth year, determine the value of the property today. $937,813 O $1,009,440 O $954,723 $990,742

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock