Question: Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of

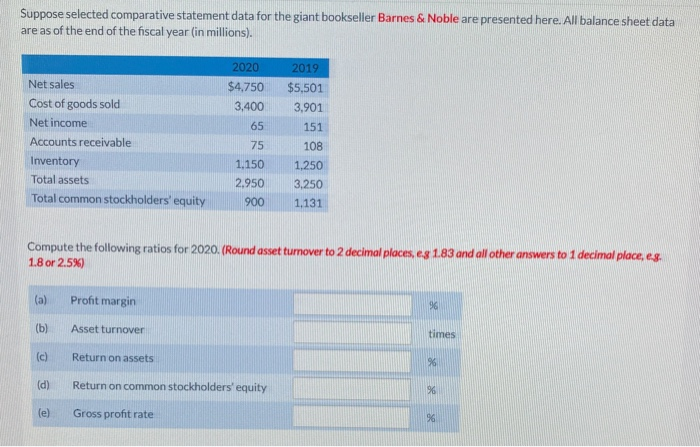

Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). 2020 $4,750 3,400 65 2019 $5,501 3,901 151 Net sales Cost of goods sold Net income Accounts receivable Inventory Total assets Total common stockholders' equity 75 108 1,150 2.950 900 1.250 3,250 1.131 Compute the following ratios for 2020. (Round asset turnover to 2 decimal places, es 1.83 and all other answers to 1 decimal place, es 1.8 or 2.5%) (a) Profit margin 96 (b) Asset turnover times (c) Return on assets 96 (d) Return on common stockholders' equity %6 (e) Gross profit rate 96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts