Question: Suppose someone has initial endowment X, (S0, S1, S2, ., Sd) (in dollar amount) in cash and d risky assets. r, R1, , Rd are

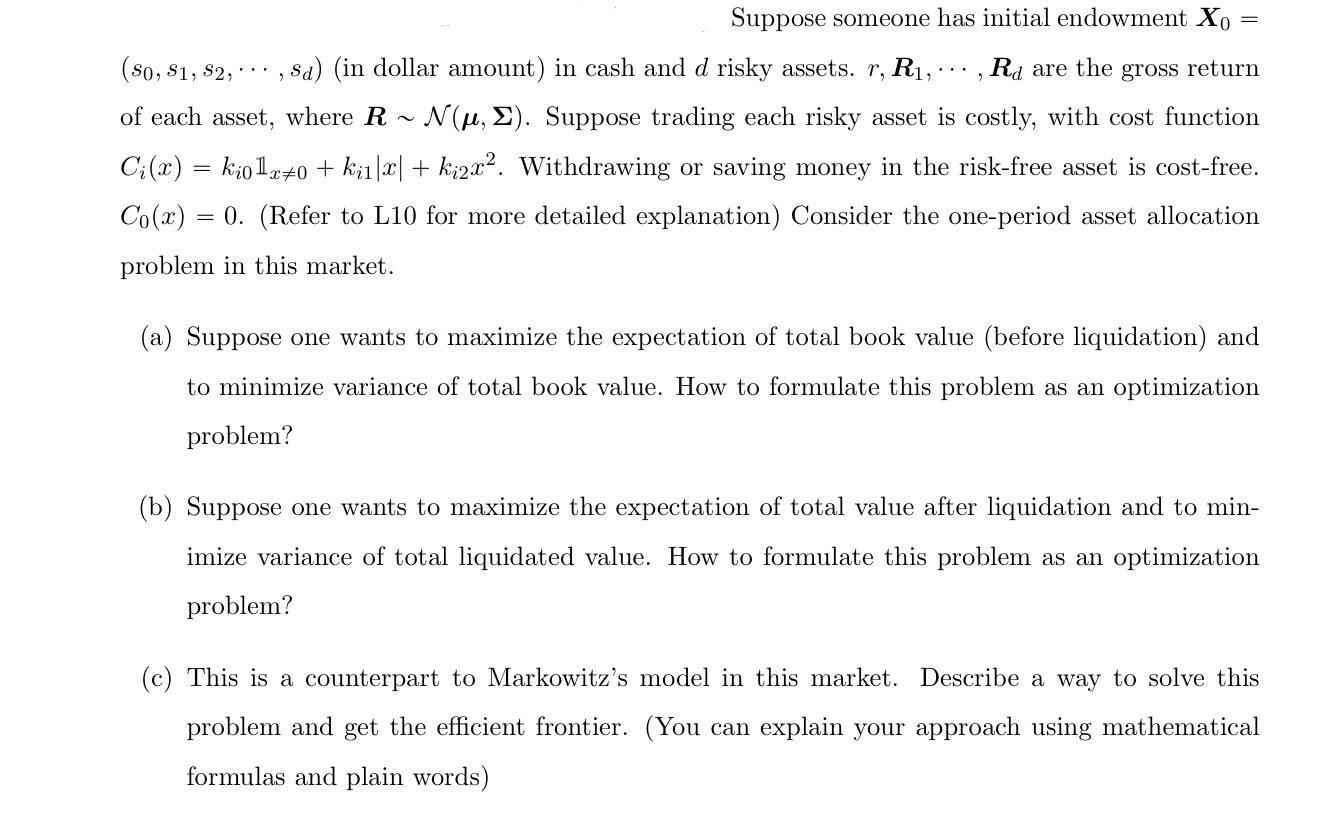

Suppose someone has initial endowment X, (S0, S1, S2, ., Sd) (in dollar amount) in cash and d risky assets. r, R1, , Rd are the gross return of each asset, where R ~ N(u, ). Suppose trading each risky asset is costly, with cost function Ci(x) = kio1x40 + kiilal + ki2x2. Withdrawing or saving money in the risk-free asset is cost-free. Co(x) = 0. (Refer to L10 for more detailed explanation) Consider the one-period asset allocation problem in this market. (a) Suppose one wants to maximize the expectation of total book value (before liquidation) and to minimize variance of total book value. How to formulate this problem as an optimization problem? (b) Suppose one wants to maximize the expectation of total value after liquidation and to min- imize variance of total liquidated value. How to formulate this problem as an optimization problem? (c) This is a counterpart to Markowitz's model in this market. Describe a way to solve this problem and get the efficient frontier. (You can explain your approach using mathematical formulas and plain words) Suppose someone has initial endowment X, (S0, S1, S2, ., Sd) (in dollar amount) in cash and d risky assets. r, R1, , Rd are the gross return of each asset, where R ~ N(u, ). Suppose trading each risky asset is costly, with cost function Ci(x) = kio1x40 + kiilal + ki2x2. Withdrawing or saving money in the risk-free asset is cost-free. Co(x) = 0. (Refer to L10 for more detailed explanation) Consider the one-period asset allocation problem in this market. (a) Suppose one wants to maximize the expectation of total book value (before liquidation) and to minimize variance of total book value. How to formulate this problem as an optimization problem? (b) Suppose one wants to maximize the expectation of total value after liquidation and to min- imize variance of total liquidated value. How to formulate this problem as an optimization problem? (c) This is a counterpart to Markowitz's model in this market. Describe a way to solve this problem and get the efficient frontier. (You can explain your approach using mathematical formulas and plain words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts