Question: Suppose that Bosa Co., a U.S.-based MNC, has been offered a project by the government of Brazil. The project lasts for a period of

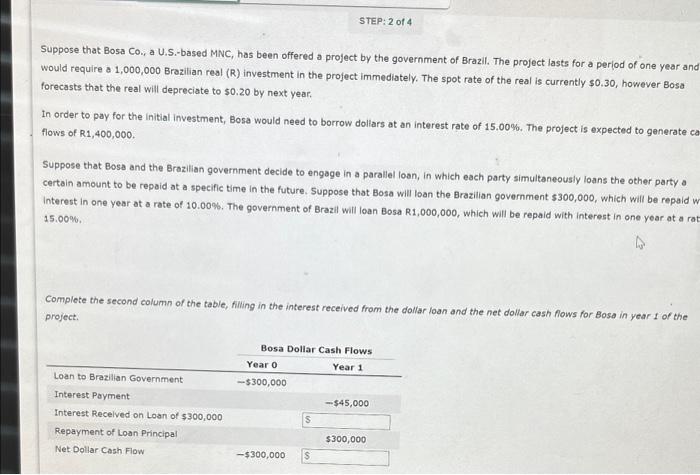

Suppose that Bosa Co., a U.S.-based MNC, has been offered a project by the government of Brazil. The project lasts for a period of one year and would require a 1,000,000 Brazilian real (R) investment in the project immediately. The spot rate of the real is currently $0.30, however Bosa forecasts that the real will depreciate to $0.20 by next year. In order to pay for the initial investment, Bosa would need to borrow dollars at an interest rate of 15.00 %. The project is expected to generate ca flows of R1,400,000. Suppose that Bosa and the Brazilian government decide to engage in a parallel loan, in which each party simultaneously loans the other party a certain amount to be repaid at a specific time in the future. Suppose that Bosa will loan the Brazilian government $300,000, which will be repaid w Interest in one year at a rate of 10.00%. The government of Brazil will loan Bosa R1,000,000, which will be repaid with interest in one year at a rat 15.00%. STEP: 2 of 4 Complete the second column of the table, filling in the interest received from the dollar loan and the net dollar cash flows for Bose in year 1 of the project. Loan to Brazilian Government Interest Payment Interest Received on Loan of $300,000 Repayment of Loan Principal Net Dollar Cash Flow Bosa Dollar Cash Flows Year 1 Year 0 -$300,000 -$300,000 S -$45,000 $300,000

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Below is the detailed calculation of cash ... View full answer

Get step-by-step solutions from verified subject matter experts