Question: Suppose that Chance Co., a U.S. based MNC, seeks to forecast the dollar value of the British pound in one month. It uses the current

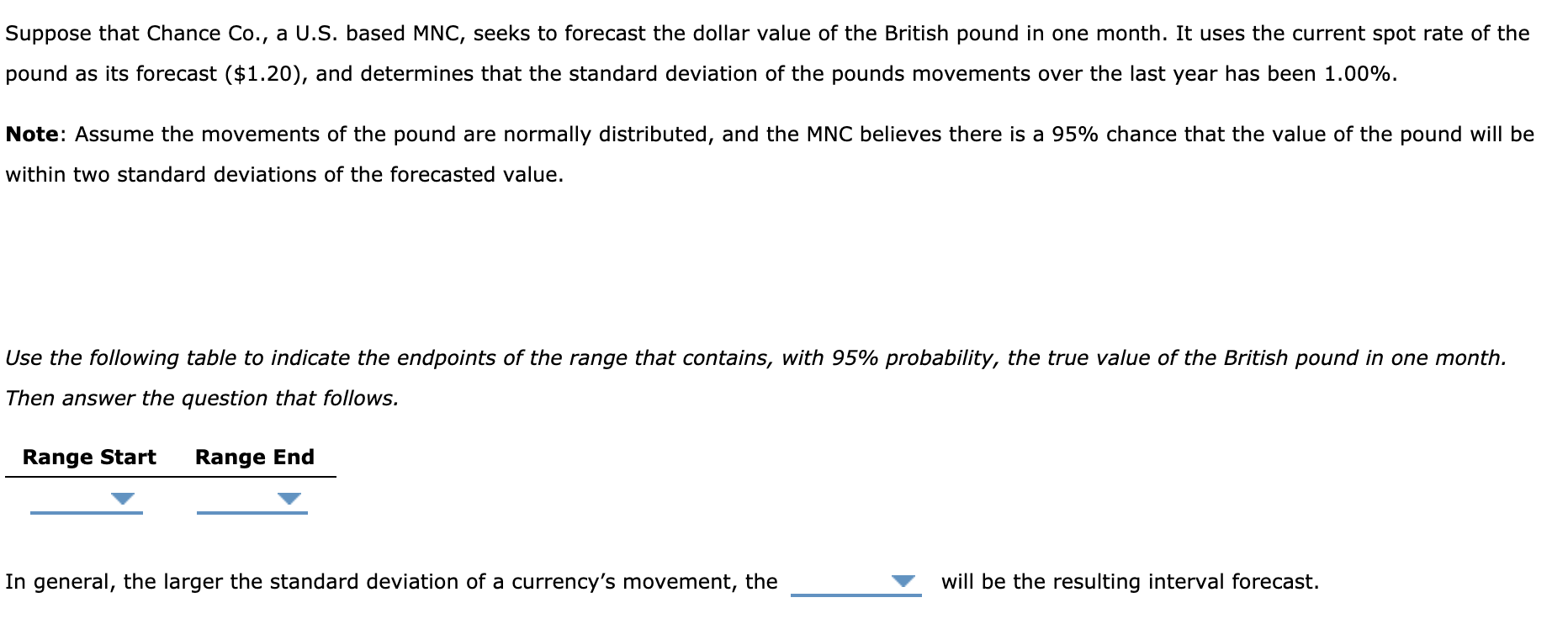

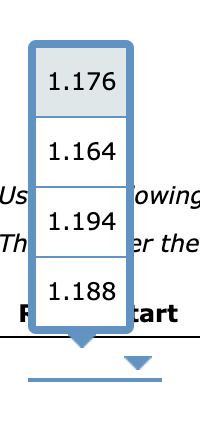

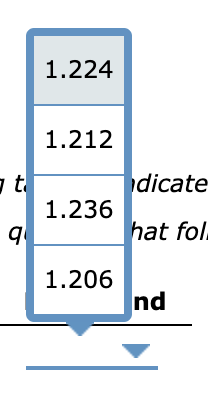

Suppose that Chance Co., a U.S. based MNC, seeks to forecast the dollar value of the British pound in one month. It uses the current spot rate of the pound as its forecast ($1.20), and determines that the standard deviation of the pounds movements over the last year has been 1.00%. Note: Assume the movements of the pound are normally distributed, and the MNC believes there is a 95% chance that the value of the pound will be within two standard deviations of the forecasted value. Use the following table to indicate the endpoints of the range that contains, with 95% probability, the true value of the British pound in one month. Then answer the question that follows. Range Start Range End In general, the larger the standard deviation of a currency's movement, the will be the resulting interval forecast. 1.176 1.164 owing 1.194 er the 1.188 tart 1.224 1.212 1.236 dicate hat fol. 1.206 nd larger smaller nt, the will be the resulting interval forecast

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts