Question: Suppose that during Problem 24.Three the bid-provide spreads for the 2 corporations are normally disbursed. For Company A the bid-offer spread has a median of

Suppose that during Problem 24.Three the bid-provide spreads for the 2 corporations are normally disbursed. For Company A the bid-offer spread has a median of zero.01 and a wellknown deviation of 0.01. For Company B the bid-provide spread has a mean of 0.02 and a widespread deviation of zero.03. What is the price of unwinding that the investor is 95% confident will not be passed? 24.Five A trader desires to unwind a position of 60 million units in an asset over 10 days. The dollar bid-offer spread as a function of day by day buying and selling volume, q, is a + becq where a = 0.2, b = zero.1, and c = 0.08 and q is measured in hundreds of thousands. The standard deviation of the rate change consistent with day is $0.1. What is the top of the line method that minimizes the 95% self assurance level for the costs? 24.6 Explain the distinction among the liquidity coverage ratio (LCR) and the net solid investment ratio (NSFR). 24.7 Why is it volatile to rely on wholesale deposits for investment? 24.8 What become the nature of the investment hazard issues of Ashanti Goldfields and Met- allgesellschaft? 24.Nine What is supposed by way of (a) fine feedback trading and (b) poor remarks trading? Which is susceptible to lead to liquidity issues? 24.10 What is supposed with the aid of liquidity-adjusted VaR? 24.11 Explain how liquidity black holes arise. How can law result in liquidity black holes? 24.12 Why is it useful to the liquidity of markets for traders to follow numerous trading strategies? Further Questions 24.Thirteen Discuss whether hedge funds are correct or awful for the liquidity of markets. 24.14 Suppose that a dealer has bought a few illiquid stocks. In particular, the trader has 100 stocks of A, that is bid $50 and offer $60, and 2 hundred shares of B, which is bid $25 and provide $35. What are the proportional bid-provide spreads? What is the effect of the high bid-offer spreads on the quantity it'd fee the dealer to unwind the portfolio? If the bid-provide spreads are normally allotted with mean $10 and standard deviation $three, what is the ninety nine% worst-case fee of unwinding in the future as a percent of the cost of the portfolio? 24.15 A dealer desires to unwind a role of two hundred,000 units in an asset over 8 days. The dollar bid-offer unfold, as a function of each day trading quantity q, is a + becq wherein a = 0.2, b = 0.15, and c = 0.1 and q is measured in thousands. The trendy deviation of the price trade consistent with day is $1.50.What is the most appropriate buying and selling strategy for minimizing the 99% confidence degree for the expenses? What is the common time the trader waits earlier than promoting? How does this average time trade as the self belief degree modifications? [12:52 PM, 11/11/2021] vii: In Problem 26.6, what's the incremental impact of every business unit on the total financial capital? Use this to allocate financial capital to commercial enterprise devices. What is the effect at the financial capital of each business unit increasing via 0.5%? Show that your outcomes are consistent with Euler's theorem. 26.8 A bank is thinking about expanding its asset management operations. The principal risk is operational hazard. It estimates the expected operational hazard loss from the new task in three hundred and sixty five days to be $2 million and the 99.Ninety seven% VaR (arising from a small hazard of an big investor lawsuit) to be $40 million. The predicted charges it'll receive from buyers for the budget below administration are $12 million per year, and administrative expenses are anticipated to be $3 million consistent with 12 months. Estimate the earlier than-tax RAROC. 26.9 RAROC may be used in two distinctive approaches. What are they? Further Questions 26.10 Suppose that daily profits (losses) are commonly allotted with a wellknown deviation of $5 million. (a) Estimate the minimum regulatory capital the financial institution is required to keep. (Assume a multiplicative element of four.Zero.) (b) Estimate the economic capital the usage of a one-year time horizon and a ninety nine.Nine% confidence level assuming that there is a correlation of zero.05 between profits (losses) on successive days. 26.11 Suppose that the monetary capital estimates for two enterprise units are Business Units 1 2 Market Risk 10 50 Credit Risk 30 30 Operational Risk 50 10

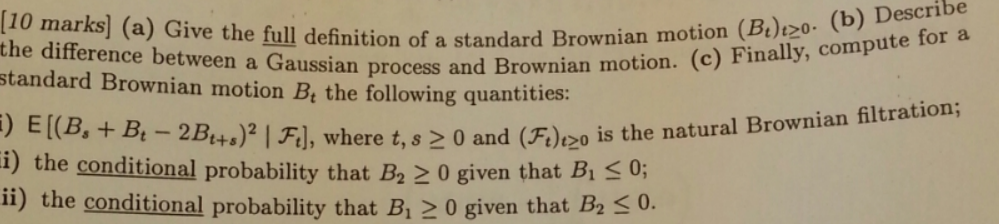

[10 marks] (a) Give the full definition of a standard Brownian motion (Be)t>o. (b) Describe the difference between a Gaussian process and Brownian motion. (c) Finally, compute for a standard Brownian motion Be the following quantities: 1) E[(B, + Be - 2Bits)? | Fi], where t, s 2 0 and (Fi)to is the natural Brownian filtration; i) the conditional probability that B2 2 0 given that Bi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts