Question: Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce

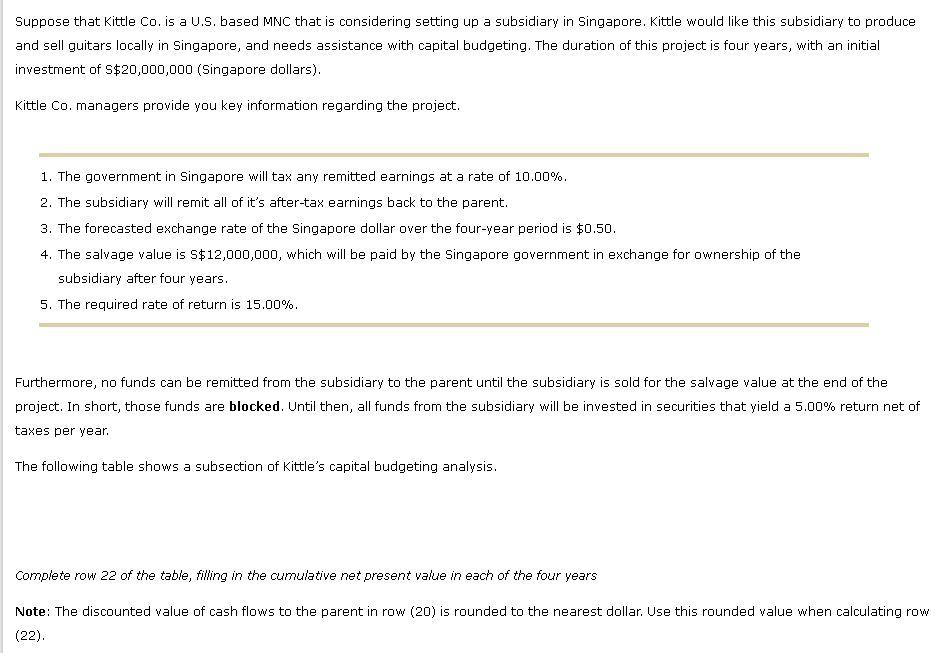

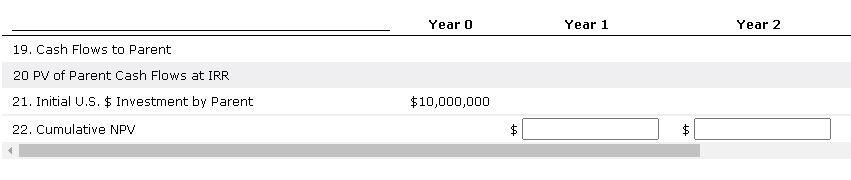

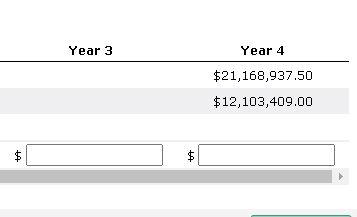

Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of 5$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it's after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is 5$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at the end of the project. In short, those funds are blocked. Until then, all funds from the subsidiary will be invested in securities that yield a 5 .00\% return net of taxes per year. The following table shows a subsection of Kittle's capital budgeting analysis. Complete row 22 of the table, filling in the cumulative net present value in each of the four years Note: The discounted value of cash flows to the parent in row (20) is rounded to the nearest dollar. Use this rounded value when calculating row (22). Year 0 Year 1 Year 2 19. Cash Flows to Parent 20PV of Parent Cash Flows at IRR 21. Initial U.S. $ Investment by Parent $10,000,000 22. Cumulative NPV \begin{tabular}{cc} Year 3 & Year 4 \\ \hline$21,168,937,50 \\ & $12,103,409,00 \end{tabular} $ $ Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of 5$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it's after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is 5$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at the end of the project. In short, those funds are blocked. Until then, all funds from the subsidiary will be invested in securities that yield a 5 .00\% return net of taxes per year. The following table shows a subsection of Kittle's capital budgeting analysis. Complete row 22 of the table, filling in the cumulative net present value in each of the four years Note: The discounted value of cash flows to the parent in row (20) is rounded to the nearest dollar. Use this rounded value when calculating row (22). Year 0 Year 1 Year 2 19. Cash Flows to Parent 20PV of Parent Cash Flows at IRR 21. Initial U.S. $ Investment by Parent $10,000,000 22. Cumulative NPV \begin{tabular}{cc} Year 3 & Year 4 \\ \hline$21,168,937,50 \\ & $12,103,409,00 \end{tabular} $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts