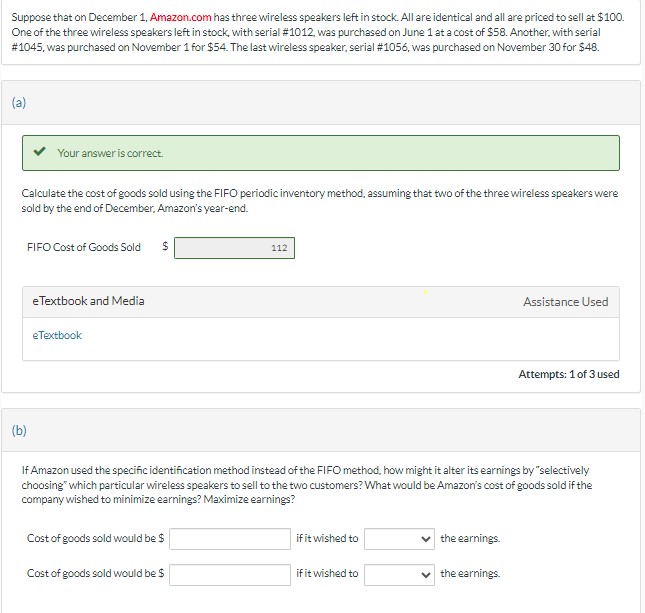

Question: Suppose that on December 1 . Amazon.com has three wireless speakers left in stock. All are identical and all are priced to sell at $

Suppose that on December

Amazon.com has three wireless speakers left in stock. All are identical and all are priced to sell at $

One of the three wireless speakers left in stock, with serial # was purchased on June at a cost of $ Another, with serial

# was purchased on November for $ The last wireless speaker, serial # was purchased on November for $

a

Your answer is correct.

Calculate the cost of goods sold using the FIFO periodic inventory method, assuming that two of the three wireless speakers were

sold by the end of December. Amazon's yearend.

FIFO Cost of Goods Sold $

eTextbook and Media

Assistance Used

eTextbook

Attempts: of used

b

If Amazon used the specific identification method instead of the FIFO method, how might it alter its earnings by "selectively

choosing" which particular wireless speakers to sell to the two customers? What would be Amazon's cost of goods sold if the

company wished to minimize earnings? Maximize earnings?

Cost of goods sold would be $

Cost of goods sold would be $

if it wished to

if it wished to

the earnings.

the earnings.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock