Question: Suppose that over the last 10 years the expected return for the S&P 500 was 6.05% with a standard deviation of 17.84% and the

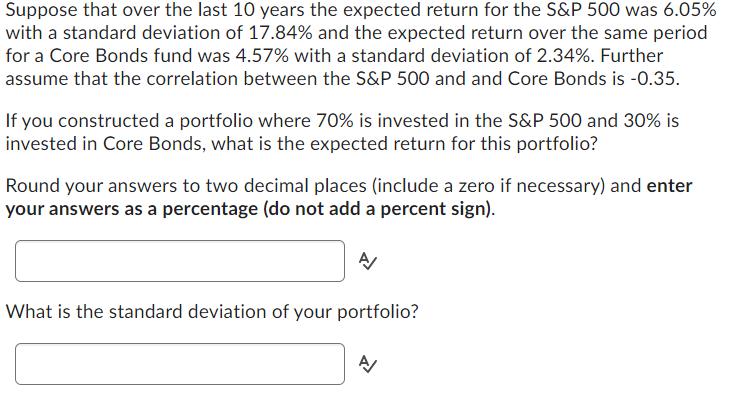

Suppose that over the last 10 years the expected return for the S&P 500 was 6.05% with a standard deviation of 17.84% and the expected return over the same period for a Core Bonds fund was 4.57% with a standard deviation of 2.34%. Further assume that the correlation between the S&P 500 and and Core Bonds is -0.35. If you constructed a portfolio where 70% is invested in the S&P 500 and 30% is invested in Core Bonds, what is the expected return for this portfolio? Round your answers to two decimal places (include a zero if necessary) and enter your answers as a percentage (do not add a percent sign). A/ What is the standard deviation of your portfolio? A/

Step by Step Solution

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts