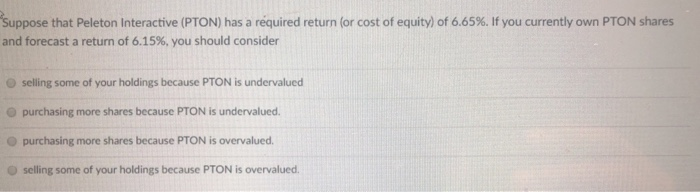

Question: Suppose that Peleton Interactive (PTON) has a required return (or cost of equity) of 6.65%. If you currently own PTON shares and forecast a return

Suppose that Peleton Interactive (PTON) has a required return (or cost of equity) of 6.65%. If you currently own PTON shares and forecast a return of 6.15%, you should consider selling some of your holdings because PTON is undervalued purchasing more shares because PTON is undervalued. purchasing more shares because PTON is overvalued, selling some of your holdings because PTON is overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts