Question: Suppose that Retrojo inc. Is a U.S. based MNC that will need to purchase F$1.70 million (Fjlan dollars, F$) worth of Imports from Fijl in

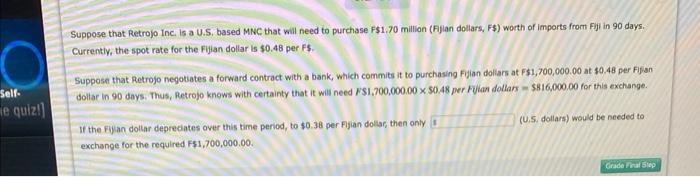

Suppose that Retrojo inc. Is a U.S. based MNC that will need to purchase F\$1.70 million (Fjlan dollars, F\$) worth of Imports from Fijl in 90 days. Currently, the spot rate for the Fijan dollar is $0.48 per F\$. Suppose that Retrojo negotsates a forward contract with a bank, which commits it to purchasing Fijian doliars at F\$1, 700,000.00 at $0.48 per Fijan dollar in 90 days. Thus, Retrojo knows with certainty that it will need F$1,700,000,0050.48 per fullan dollars = $8 I 6,000.00 for this exchange. If the Fiyan doltar depredates over this time period, to $0.38 per figan doliar, then only (U,S. dollars) would be needed to exchange for the required Fs {,700,000,00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts