Question: Suppose that Sanders Co., a U.S.-based MNC, is considering options to finance its U.S. operations with a one-year loan. Sanders' bank offers a oneyear loan

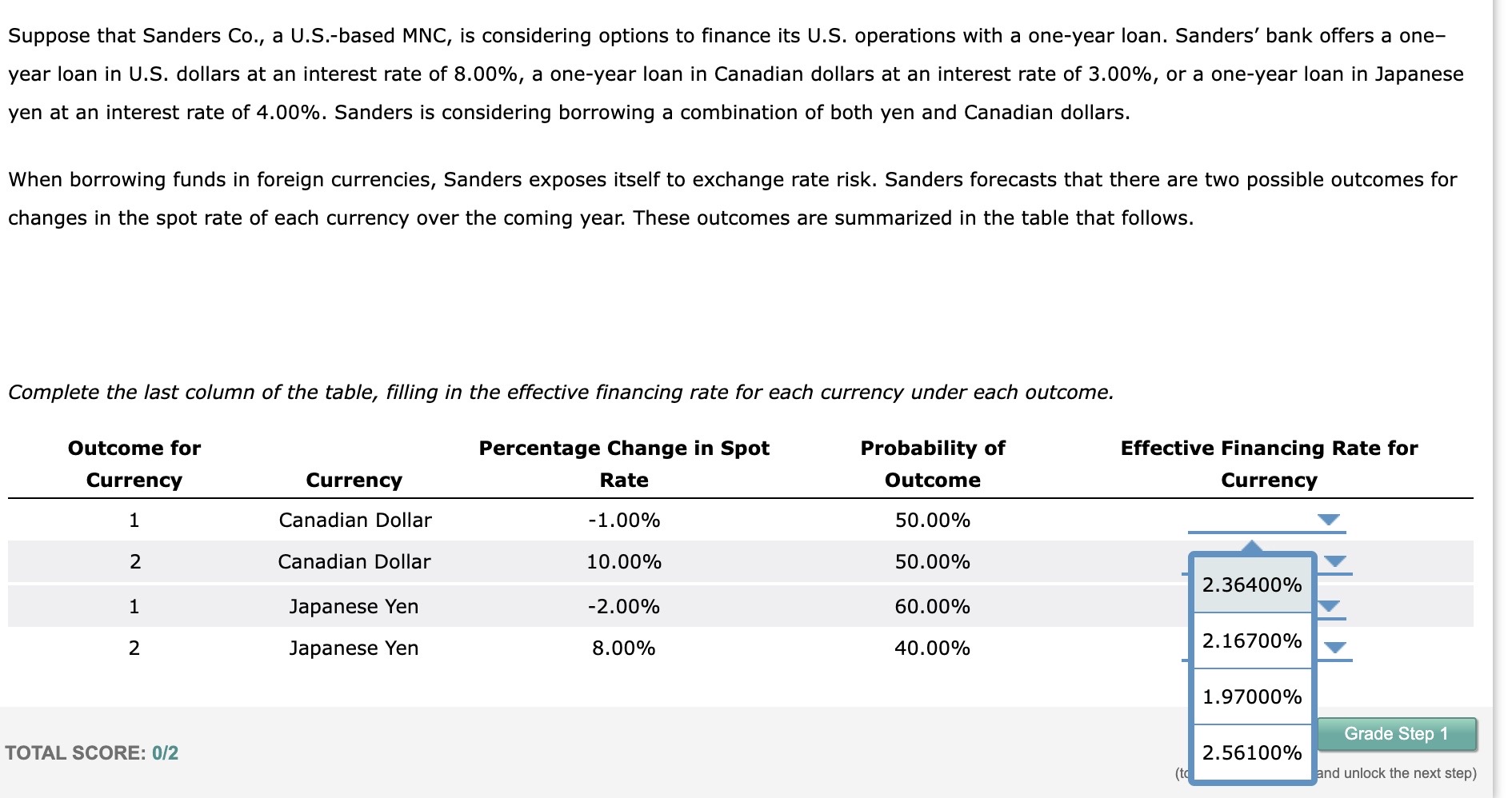

Suppose that Sanders Co., a U.S.-based MNC, is considering options to finance its U.S. operations with a one-year loan. Sanders' bank offers a oneyear loan in U.S. dollars at an interest rate of 8.00%, a one-year loan in Canadian dollars at an interest rate of 3.00%, or a one-year loan in Japanese yen at an interest rate of 4.00%. Sanders is considering borrowing a combination of both yen and Canadian dollars. When borrowing funds in foreign currencies, Sanders exposes itself to exchange rate risk. Sanders forecasts that there are two possible outcomes for changes in the spot rate of each currency over the coming year. These outcomes are summarized in the table that follows. Complete the last column of the table, filling in the effective financing rate for each currency under each outcome

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts