Question: Suppose that Sherman Co., a U.S.-based MNC is considering a plan to establish a subsidiary in Singapore. The MNC would establish the subsidiary using an

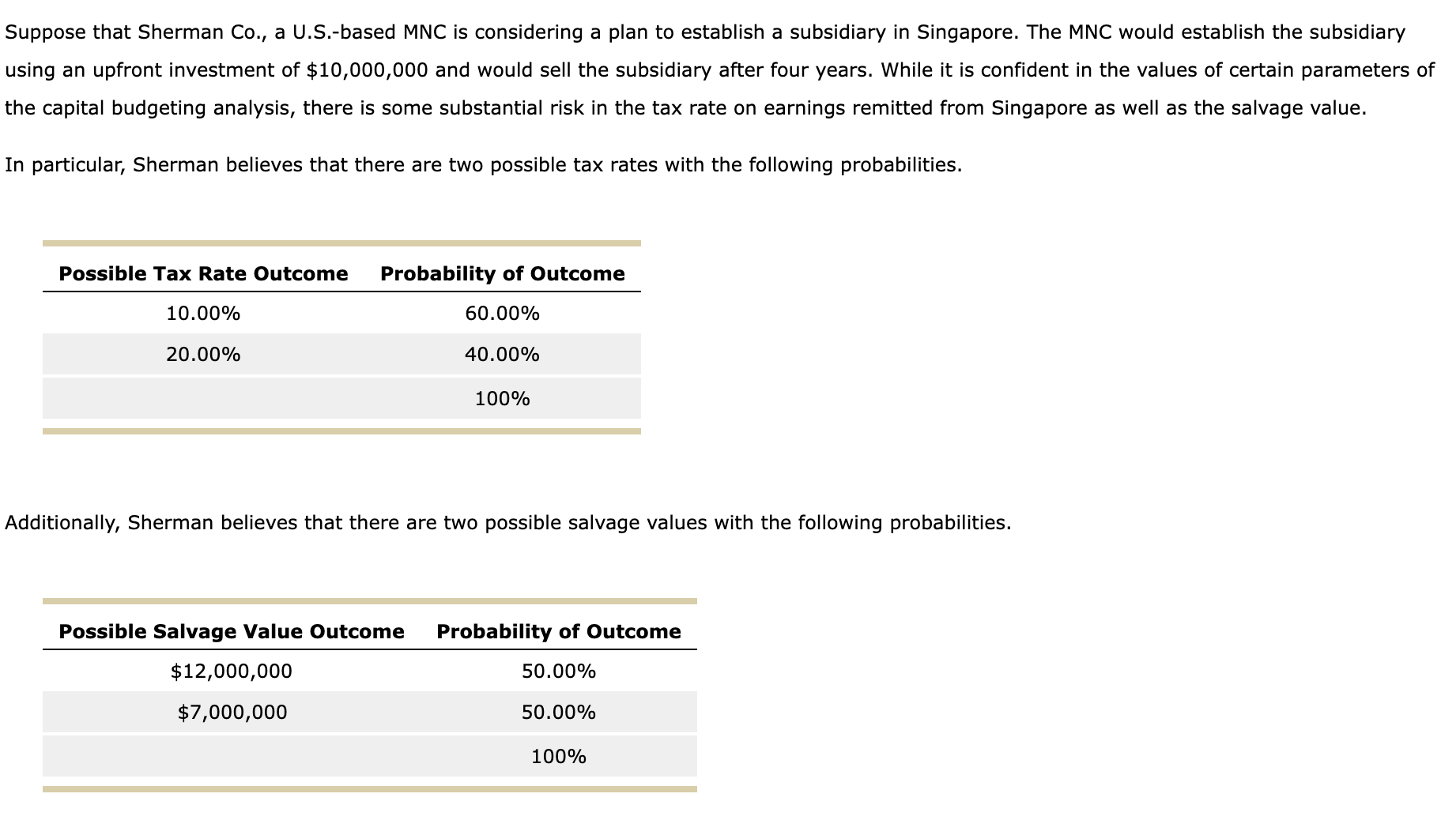

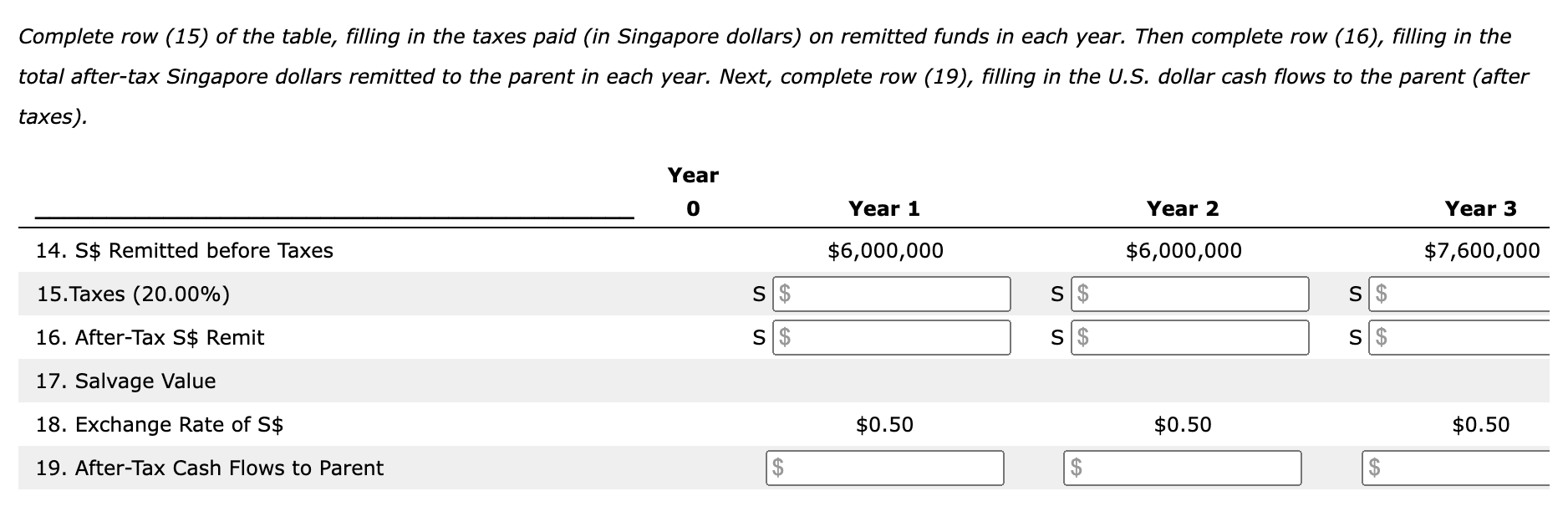

Suppose that Sherman Co., a U.S.-based MNC is considering a plan to establish a subsidiary in Singapore. The MNC would establish the subsidiary using an upfront investment of $10,000,000 and would sell the subsidiary after four years. While it is confident in the values of certain parameters of the capital budgeting analysis, there is some substantial risk in the tax rate on earnings remitted from Singapore In particular, Sherman believes that there are two possible tax rates with the following probabilities. Additionally, Sherman believes that there are two possible salvage values with the following probabilities. Complete row (15) of the table, filling in the taxes paid (in Singapore dollars) on remitted funds in each year. Then complete row (16), filling in the total after-tax Singapore dollars remitted to the parent in each year. Next, complete row (19), filling in the U.S. dollar cash flows to the parent (after taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts