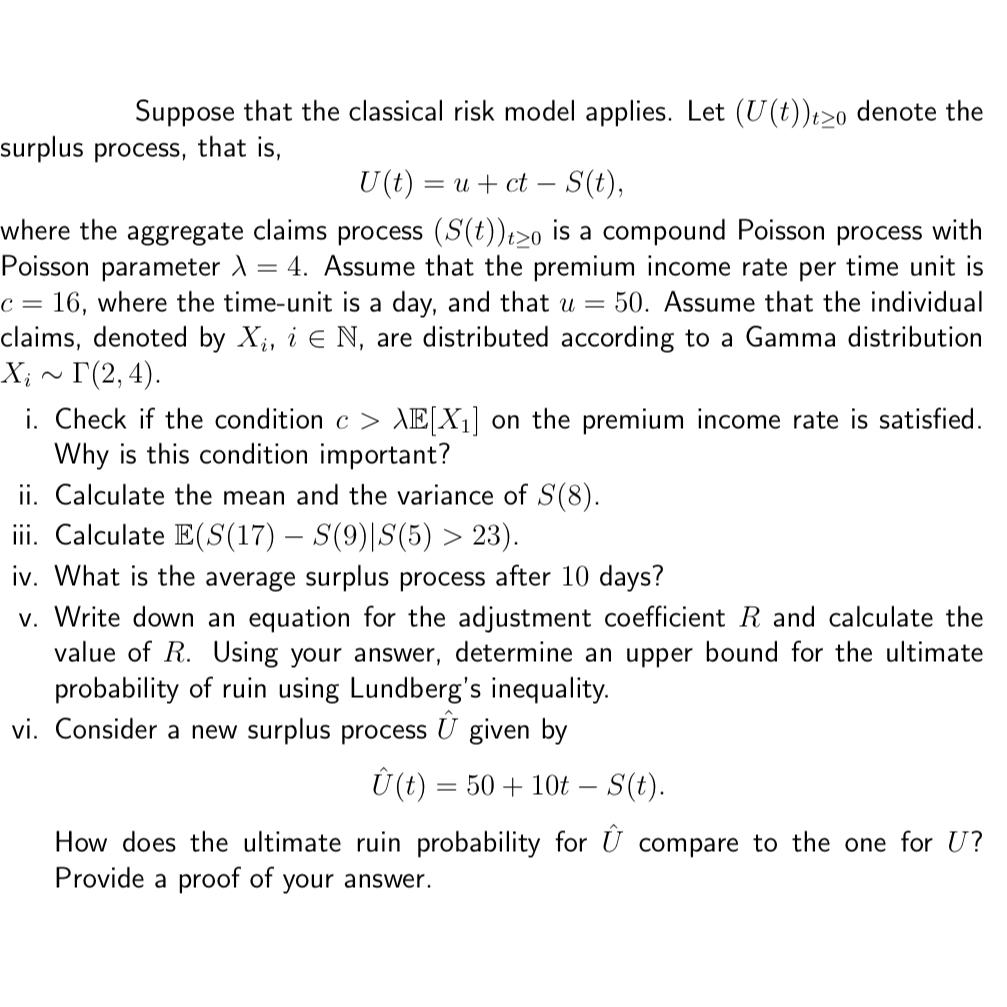

Question: Suppose that the classical risk model applies. Let ( U ( t ) ) t 0 denote the surplus process, that is , U (

Suppose that the classical risk model applies. Let denote the surplus process, that is

where the aggregate claims process is a compound Poisson process with Poisson parameter Assume that the premium income rate per time unit is where the timeunit is a day, and that Assume that the individual claims, denoted by iinN, are distributed according to a Gamma distribution

i Check if the condition on the premium income rate is satisfied. Why is this condition important?

ii Calculate the mean and the variance of

iii. Calculate

iv What is the average surplus process after days?

v Write down an equation for the adjustment coefficient and calculate the value of Using your answer, determine an upper bound for the ultimate probability of ruin using Lundberg's inequality.

vi Consider a new surplus process hat given by

hat

How does the ultimate ruin probability for hat compare to the one for Provide a proof of your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock