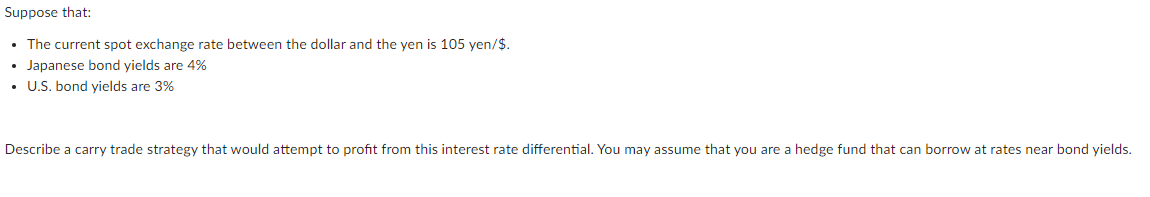

Question: Suppose that: The current spot exchange rate between the dollar and the yen is 105 yen/$. Japanese bond yields are 4% U.S. bond yields are

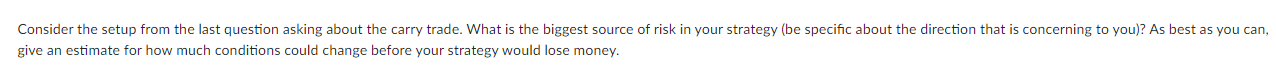

Suppose that: The current spot exchange rate between the dollar and the yen is 105 yen/$. Japanese bond yields are 4% U.S. bond yields are 3% Describe a carry trade strategy that would attempt to profit from this interest rate differential. You may assume that you are a hedge fund that can borrow at rates near bond yields. Consider the setup from the last question asking about the carry trade. What is the biggest source of risk in your strategy (be specific about the direction that is concerning to you)? As best as you can, give an estimate for how much conditions could change before your strategy would lose money. Suppose that: The current spot exchange rate between the dollar and the yen is 105 yen/$. Japanese bond yields are 4% U.S. bond yields are 3% Describe a carry trade strategy that would attempt to profit from this interest rate differential. You may assume that you are a hedge fund that can borrow at rates near bond yields. Consider the setup from the last question asking about the carry trade. What is the biggest source of risk in your strategy (be specific about the direction that is concerning to you)? As best as you can, give an estimate for how much conditions could change before your strategy would lose money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts