Question: Suppose that the current term structure (continuously compounded rates) is given by: r(0,0.5) = 1.2% r(0,1)= 1.6% r(0,1.5) = 2% r(0,2)= 2.2% 0 Furthermore, assume

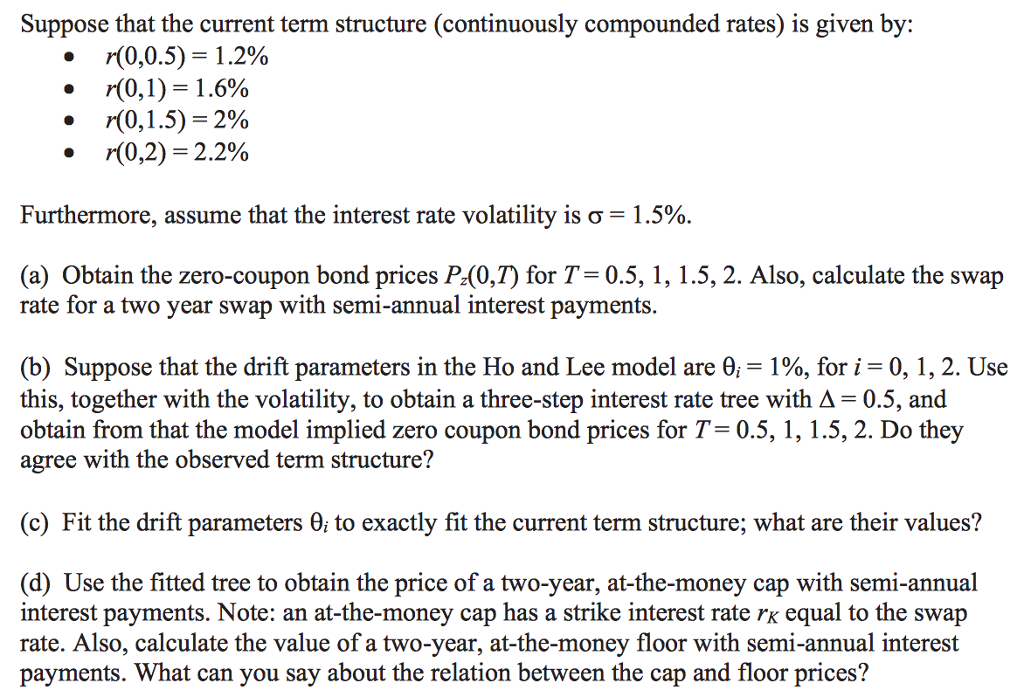

Suppose that the current term structure (continuously compounded rates) is given by: r(0,0.5) = 1.2% r(0,1)= 1.6% r(0,1.5) = 2% r(0,2)= 2.2% 0 Furthermore, assume that the interest rate volatility is o = 1.5%. (a) Obtain the zero-coupon bond prices Pz(0,7) for T=0.5, 1, 1.5, 2. Also, calculate the swap rate for a two year swap with semi-annual interest payments. (b) Suppose that the drift parameters in the Ho and Lee model are 0; = 1%, for i = 0, 1, 2. Use this, together with the volatility, to obtain a three-step interest rate tree with A=0.5, and obtain from that the model implied zero coupon bond prices for T=0.5, 1, 1.5, 2. Do they agree with the observed term structure? (c) Fit the drift parameters 0; to exactly fit the current term structure; what are their values? (d) Use the fitted tree to obtain the price of a two-year, at-the-money cap with semi-annual interest payments. Note: an at-the-money cap has a strike interest rate rk equal to the swap rate. Also, calculate the value of a two-year, at-the-money floor with semi-annual interest payments. What can you say about the relation between the cap and floor prices? Suppose that the current term structure (continuously compounded rates) is given by: r(0,0.5) = 1.2% r(0,1)= 1.6% r(0,1.5) = 2% r(0,2)= 2.2% 0 Furthermore, assume that the interest rate volatility is o = 1.5%. (a) Obtain the zero-coupon bond prices Pz(0,7) for T=0.5, 1, 1.5, 2. Also, calculate the swap rate for a two year swap with semi-annual interest payments. (b) Suppose that the drift parameters in the Ho and Lee model are 0; = 1%, for i = 0, 1, 2. Use this, together with the volatility, to obtain a three-step interest rate tree with A=0.5, and obtain from that the model implied zero coupon bond prices for T=0.5, 1, 1.5, 2. Do they agree with the observed term structure? (c) Fit the drift parameters 0; to exactly fit the current term structure; what are their values? (d) Use the fitted tree to obtain the price of a two-year, at-the-money cap with semi-annual interest payments. Note: an at-the-money cap has a strike interest rate rk equal to the swap rate. Also, calculate the value of a two-year, at-the-money floor with semi-annual interest payments. What can you say about the relation between the cap and floor prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts