Question: Suppose that the required return for a project is 11% with unconventional cash flows. Suppose your firm uses IRR to determine whether or not to

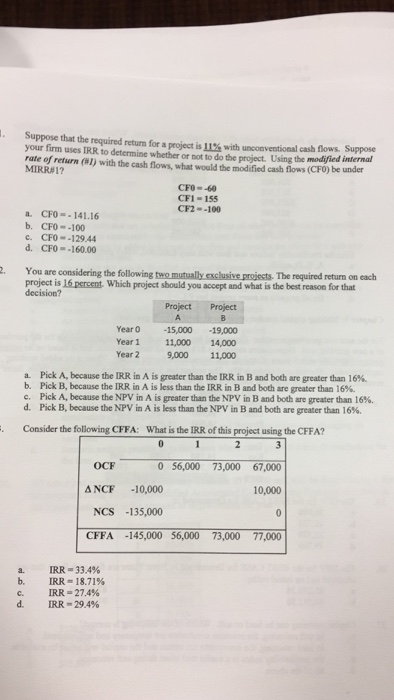

Suppose that the required return for a project is 11% with unconventional cash flows. Suppose your firm uses IRR to determine whether or not to do the project. Using the modified internal rate of return (#1) with the cash flows, what would the modified cash flows (CF0) be under MIRR#1? CF0 = -60 CF1 = 155 CF2 = -100 a. CF0 = -141.16 b. CF0 = -100 c. CF0 = -129.44 d. CF0 = -160 00 You are considering the following two mutually exclusive projects. The required return on each project is 16 percent. Which project should you accept and what is the best reason for that decision? a. Pick A, because the IRR in A is greater than the IRR in B and both are greater than 16%. b. Pick B, because the IRR in A is less than the IRR in B and both are greater than 16%. c. Pick A, because the NPV in A is greater than the NPV in B and both are greater than 16%. d. Pick B, because the NPV in A is less than the NPV in B and both are greater than 16%. Consider the following CFFA: What a the IRR of this project Using the CFFA? a. IRR = 33.4% b. IRR = 18.71% c. IRR = 27.4% d. IRR = 29.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts