Question: Suppose that the term structure is flat at 2% (Treasury yield, APR compounded semi-annually). Consider the following two investment strategies. (i) You invest $100 to

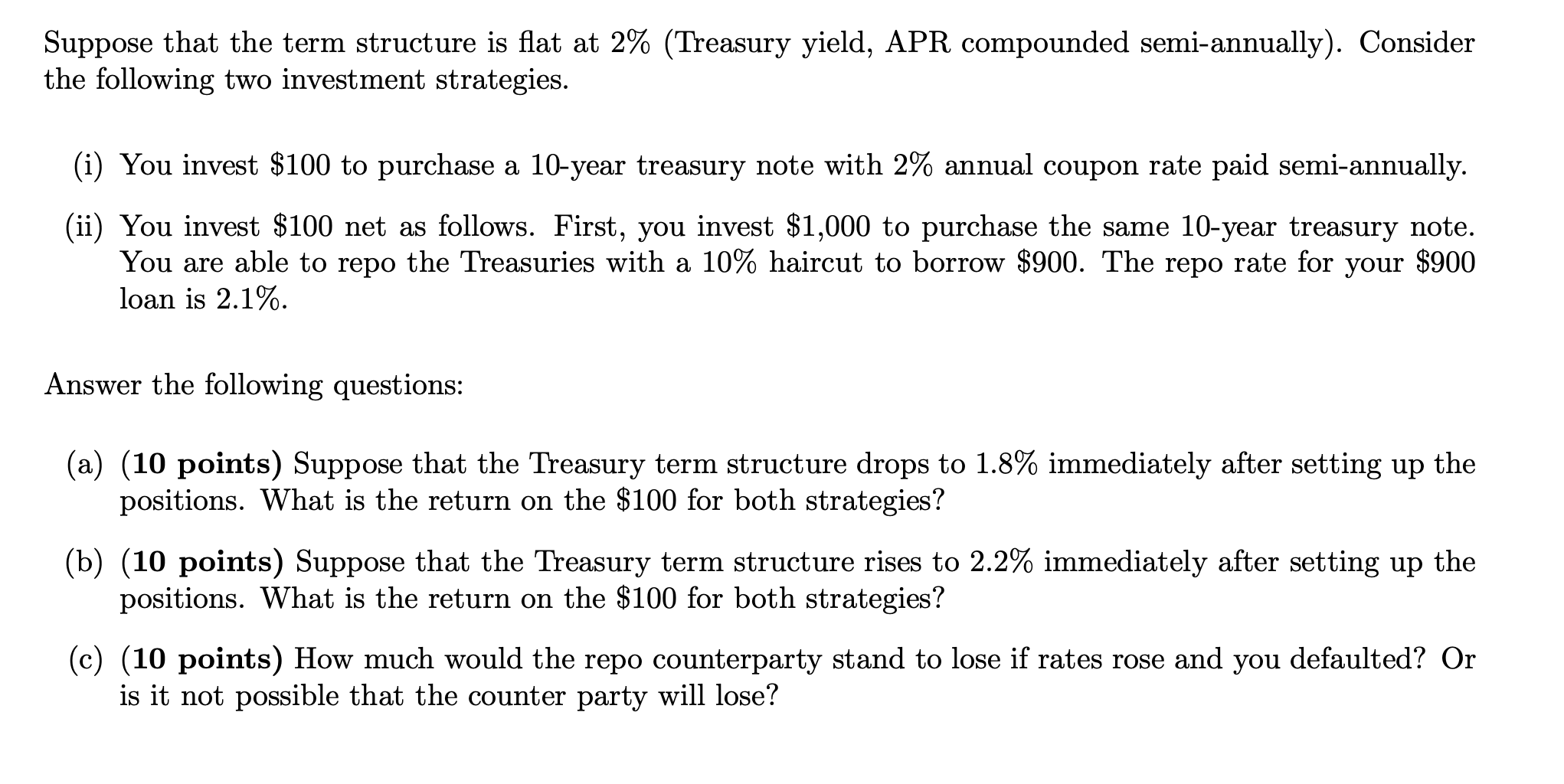

Suppose that the term structure is flat at 2% (Treasury yield, APR compounded semi-annually). Consider the following two investment strategies. (i) You invest $100 to purchase a 10-year treasury note with 2% annual coupon rate paid semi-annually. (ii) You invest $100 net as follows. First, you invest $1,000 to purchase the same 10-year treasury note. You are able to repo the Treasuries with a 10% haircut to borrow $900. The repo rate for your $900 loan is 2.1%. Answer the following questions: (a) (10 points) Suppose that the Treasury term structure drops to 1.8% immediately after setting up the positions. What is the return on the $100 for both strategies? (b) (10 points) Suppose that the Treasury term structure rises to 2.2% immediately after setting up the positions. What is the return on the $100 for both strategies? (c) (10 points) How much would the repo counterparty stand to lose if rates rose and you defaulted? Or is it not possible that the counter party will lose? Suppose that the term structure is flat at 2% (Treasury yield, APR compounded semi-annually). Consider the following two investment strategies. (i) You invest $100 to purchase a 10-year treasury note with 2% annual coupon rate paid semi-annually. (ii) You invest $100 net as follows. First, you invest $1,000 to purchase the same 10-year treasury note. You are able to repo the Treasuries with a 10% haircut to borrow $900. The repo rate for your $900 loan is 2.1%. Answer the following questions: (a) (10 points) Suppose that the Treasury term structure drops to 1.8% immediately after setting up the positions. What is the return on the $100 for both strategies? (b) (10 points) Suppose that the Treasury term structure rises to 2.2% immediately after setting up the positions. What is the return on the $100 for both strategies? (c) (10 points) How much would the repo counterparty stand to lose if rates rose and you defaulted? Or is it not possible that the counter party will lose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts