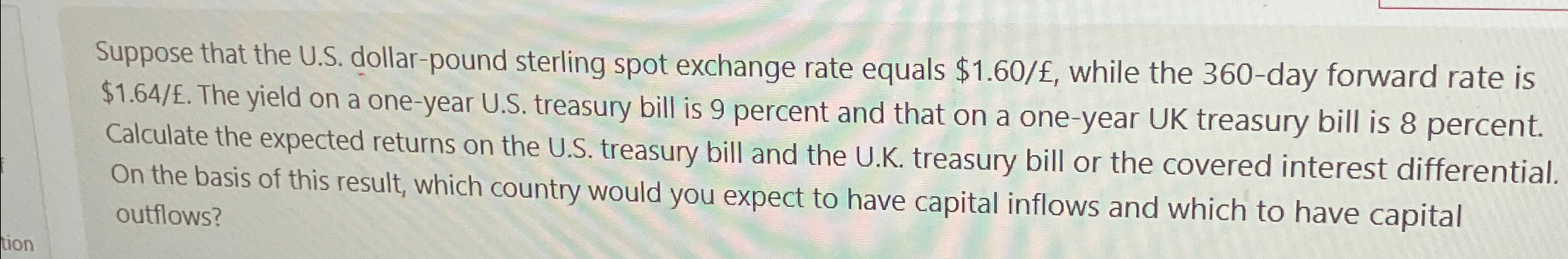

Question: Suppose that the U . S . dollar - pound sterling spot exchange rate equals $ 1 . 6 0 , while the 3 6

Suppose that the US dollarpound sterling spot exchange rate equals $ while the day forward rate is $ The yield on a oneyear US treasury bill is percent and that on a oneyear UK treasury bill is percent. Calculate the expected returns on the US treasury bill and the UK treasury bill or the covered interest differential. On the basis of this result, which country would you expect to have capital inflows and which to have capital outflows?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock