Question: Suppose that there is an investor, whose risk aversion coefficient is 4 and her utility function is U = E(r) - . There are

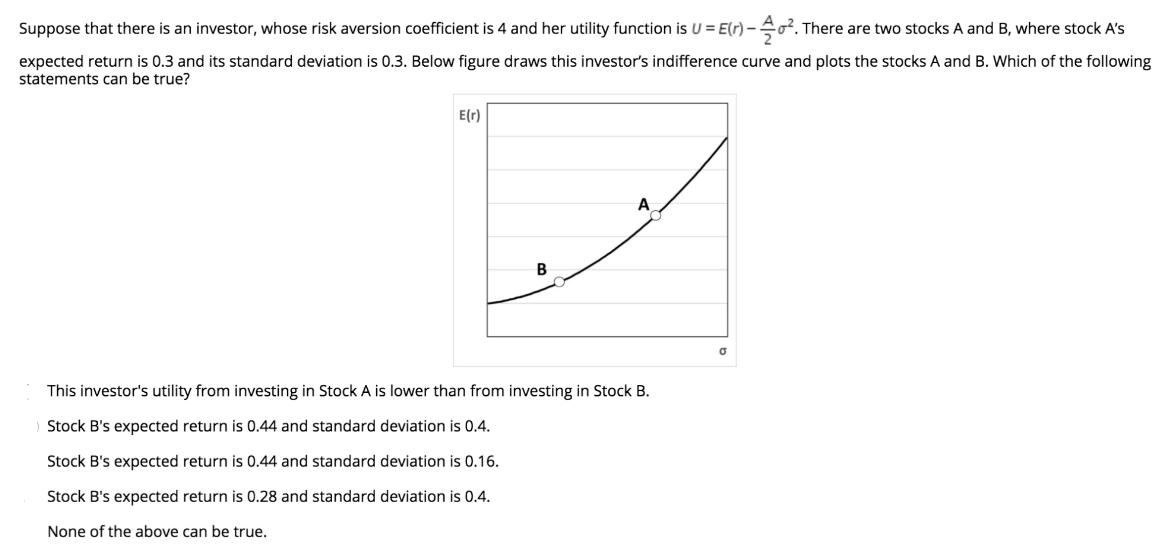

Suppose that there is an investor, whose risk aversion coefficient is 4 and her utility function is U = E(r) - . There are two stocks A and B, where stock A's expected return is 0.3 and its standard deviation is 0.3. Below figure draws this investor's indifference curve and plots the stocks A and B. Which of the following statements can be true? E(r) B A This investor's utility from investing in Stock A is lower than from investing in Stock B. Stock B's expected return is 0.44 and standard deviation is 0.4. Stock B's pected return is 0.44 and standard deviation is 0.16. Stock B's expected return is 0.28 and standard deviation is 0.4. None of the above can be true. 0

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below ANSWER B ... View full answer

Get step-by-step solutions from verified subject matter experts