Question: Suppose that there two bonds A and B that may default and let TA and TB denote their respective default times. Suppose that TA ~Exponential(NA

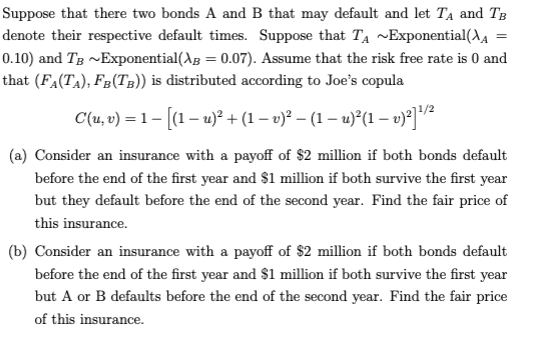

Suppose that there two bonds A and B that may default and let TA and TB denote their respective default times. Suppose that TA ~Exponential(NA 0.10) and Tg ~Exponential(AB = 0.07). Assume that the risk free rate is 0 and that (FA(TA), Fr(TB)) is distributed according to Joe's copula C(4,v) = 1 [(1 u)2 + (1 u)2 (1 u)?(1 v)a}? (a) Consider an insurance with a payoff of $2 million if both bonds default before the end of the first year and $1 million if both survive the first year but they default before the end of the second year. Find the fair price of this insurance. (b) Consider an insurance with a payoff of $2 million if both bonds default before the end of the first year and $1 million if both survive the first year but A or B defaults before the end of the second year. Find the fair price of this insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts