Question: Suppose that TRM Consulting Services has discussed its need for capital with its investment bankers. The bankers have estimated that TRM can raise new funds

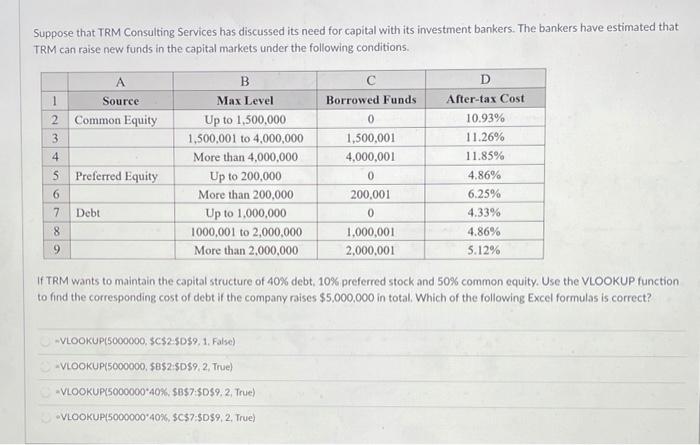

Suppose that TRM Consulting Services has discussed its need for capital with its investment bankers. The bankers have estimated that TRM can raise new funds in the capital markets under the following conditions. A B D 1 Source Max Level Borrowed Funds After-tax Cost 2 Common Equity Up to 1,500,000 0 10.93% 3 1,500,001 to 4,000,000 1,500,001 11.26% 4 4 4,000,001 11.85% S Preferred Equity 0 4.86% More than 4,000,000 Up to 200,000 More than 200,000 Up to 1,000,000 6 200,001 6.25% 7 Debt 0 4.33% 8 1000,001 to 2,000,000 1,000,001 4.86% 9 More than 2,000,000 2,000,001 5.12% If TRM wants to maintain the capital structure of 40% debt, 10% preferred stock and 50% common equity. Use the VLOOKUP function to find the corresponding cost of debt if the company raises $5,000,000 in total. Which of the following Excel formulas is correct? VLOOKUP(5000000, $C$2:$D$9. 1. False) VLOOKUP(5000000, $B$2:$D$9 2. True) VLOOKUP(5000000*40% $B$2:$D$9.2. True) VLOOKUP(5000000'40%, $C$7:50$9, 2. True)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts