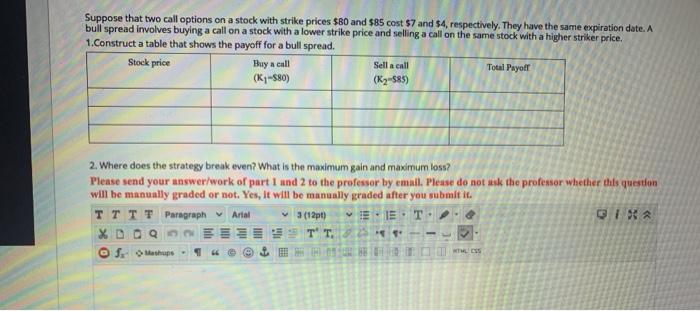

Question: Suppose that two call options on a stock with strike prices $80 and $85 cost $7 and 54, respectively. They have the same expiration date.

Suppose that two call options on a stock with strike prices $80 and $85 cost $7 and 54, respectively. They have the same expiration date. A bull spread involves buying a call on a stock with a lower strike price and selling a call on the same stock with a higher striker price, 1.Construct a table that shows the payoff for a bull spread. Stock price Buy a call Sella call Total Puyor (K1-580) (Ky-585) 2. Where does the strategy break even? What is the maximum gain and maximum loss? Please send your answer/work of part 1 and 2 to the professor by email. Please do not ask the professor whether the question will be manually graded or not. Yes, it will be manually graded after you submit it. TTTT Paragraph Ariel 3 (12pt) EET QI X DOO T THE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts