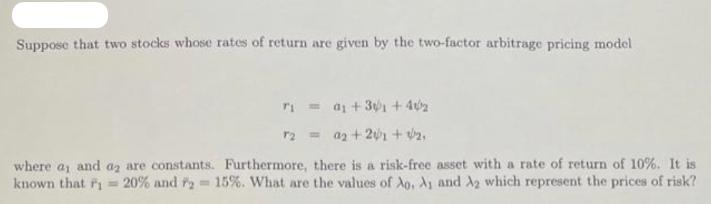

Question: Suppose that two stocks whose rates of return are given by the two-factor arbitrage pricing model r= a +31 +42 r2 = 02 +241

Suppose that two stocks whose rates of return are given by the two-factor arbitrage pricing model r= a +31 +42 r2 = 02 +241 +2, where a, and a2 are constants. Furthermore, there is a risk-free asset with a rate of return of 10%. It is known that F= 20% and 2 = 15%. What are the values of Ao. A and A2 which represent the prices of risk?

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

To find the values of 0 1 and 2 which represent the prices of risk we need to solve the given system ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock